Dictionary For Financial Terms

Section One

“Accounting”

Debt

Corporate debt.

Net Working Capital (NWC)

Measurement of financial health.

Cash Flow From Operations

A section in cash flow statement.

Accounting Overview

A summary on accounting.

Balance Sheet

One of the three financial statements.

Retained Earnings

An item under equity section.

Account Receivable

An item in current asset.

Cash Flow Statement

One of the three financial statements.

Dividend

A "reward" to shareholders.

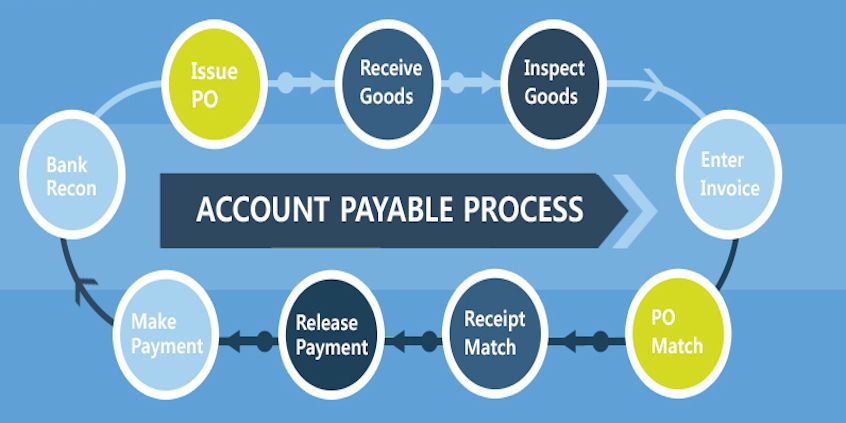

Account Payable

An item under current liabilities.

Income Statement

One of the three financial statements.

Depreciation

Cost-spreading accounting strategy.

Operating Income & EBIT

Reflects a company's operation.

Amortization

Cost-spreading strategy.

Net Income

An indicator of profitability.

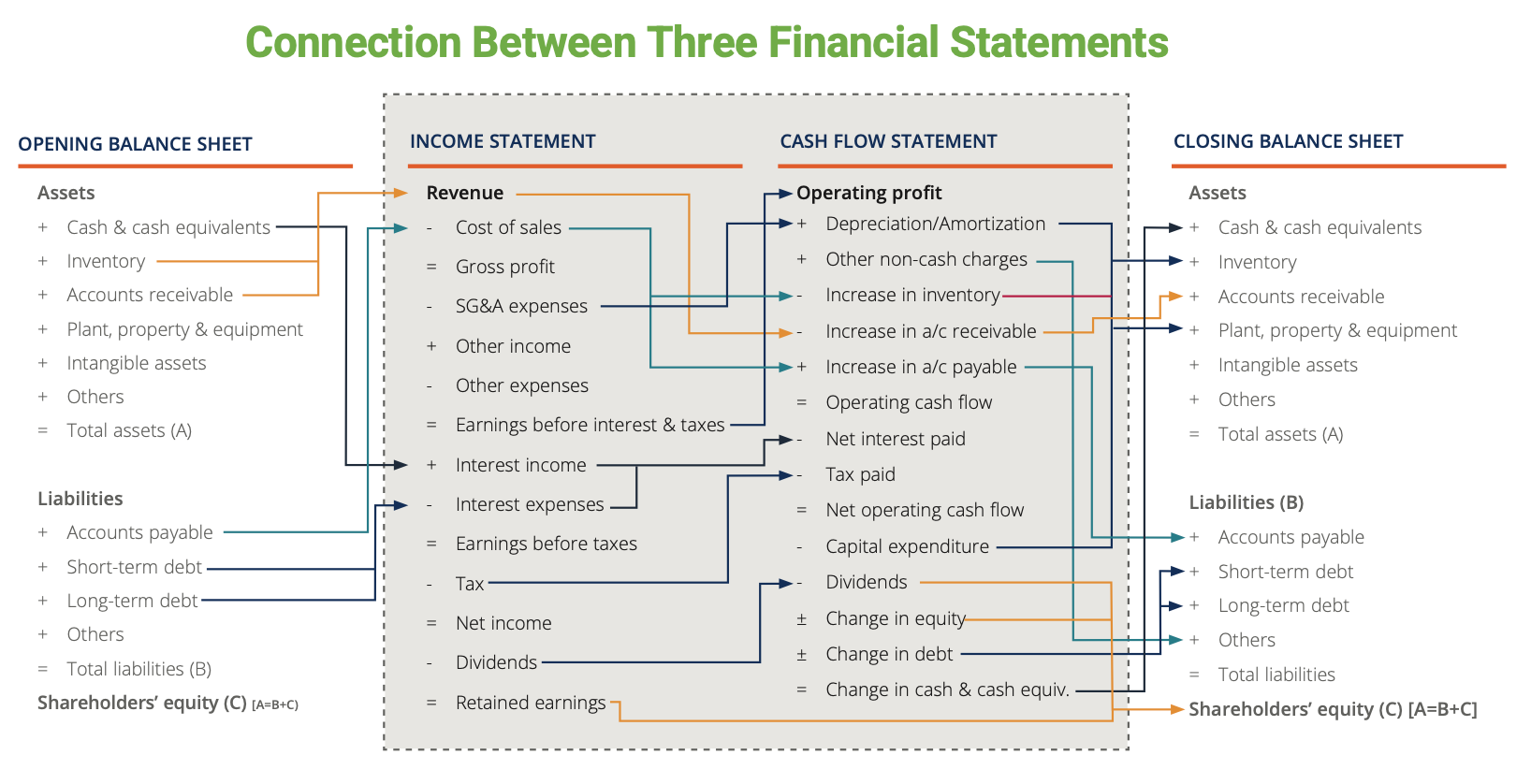

Connect Financials

Relationship in the three statements.

Inventory

An item in current asset.

Revenue

The first item on income statement.

Cash Flow From Investing

A section in cash flow statement.

EBITDA

An item for profitability.

Cash Flow From Financing

A section in cash flow statement.

SG&A

A company's indirect cost.

COGS

COGS: direct cost.

Gross Profit

An indicator for profitability.

PP&E

Property, plant, and equipment.

Section Two

“Valuation”

Internal Rate of Return

A type of discount rate.

EV/EBITDA

A financial valuation metric.

Free Cash Flow (FCF)

Company operation efficiency.

Beta (β)

Measurement of volatility.

Discount Rate

Financial valuation metric.

Earnings Per Share (EPS)

A profitability metric.

Weighted Average Cost of Capital (WACC)

Discount rate of companies in DCF.

Present Value (PV) and Net Present Value (NPV)

Two calculations in DCF.

Quick Ratio

Financial metric for liquidity.

Alpha (α)

Excess return, abnormal return.

Time Value of Money (TVM)

The foundation for DCF Model.

Price-To-Earning (P/E)

A financial valuation metric.

Excel: Income Statement

Breakdown of income statement.

Enterprise Value (EV)

A metric for company's net worth.

Current Ratio

Financial metric for liquidity.

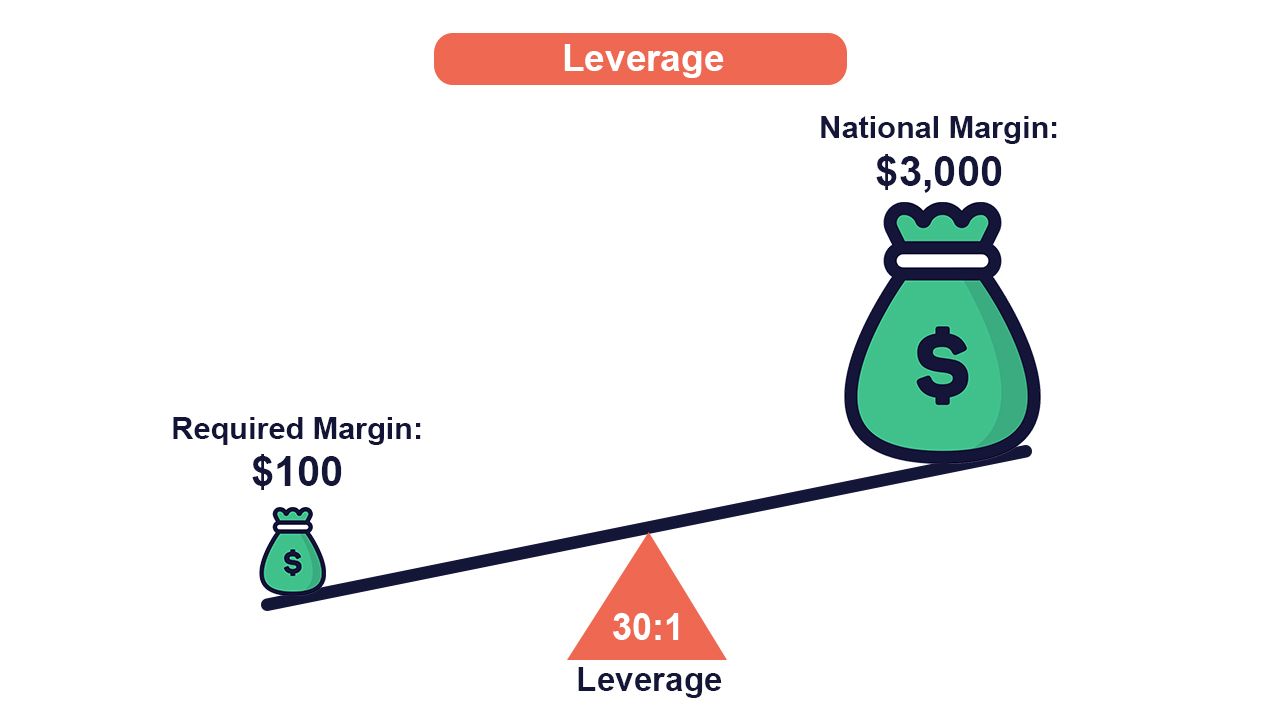

Debt-to-Capital Ratio

Liquidity and leverage ratio.

Risk-Free Rate (Rf)

Zero-risk return.

Price-to-Sales (P/S)

A financial valuation metric.

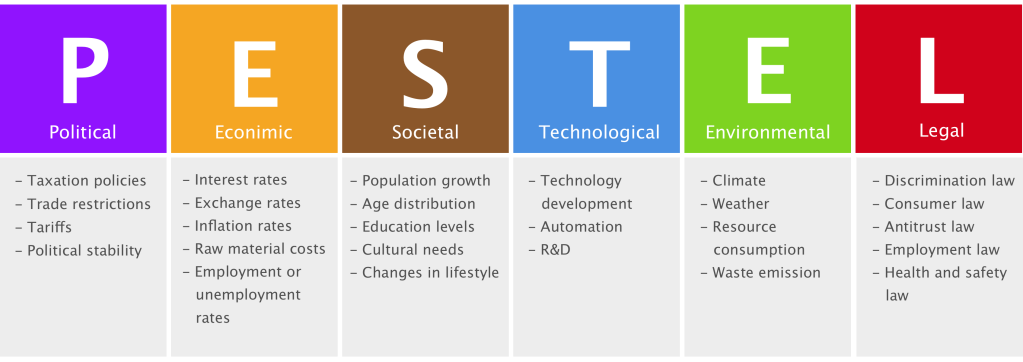

Corporate Valuation Overview

Introduction to corporate valuation.

Excel: Balance Sheet

Breakdown of balance sheet.

Return On Assets (ROA)

A measurement of profitability.

DCF: Using Excel

Application of DCF.

Return On Equity (ROE)

A measurement of profitability.

Price-to-Book (P/B)

A financial valuation metric.

Section Three

“Trading”

Section Four

“Portfolio”

Types of Risk

Risk-Averse, -Neutral, -Seeking

CAPM

Capital Asset Pricing Model

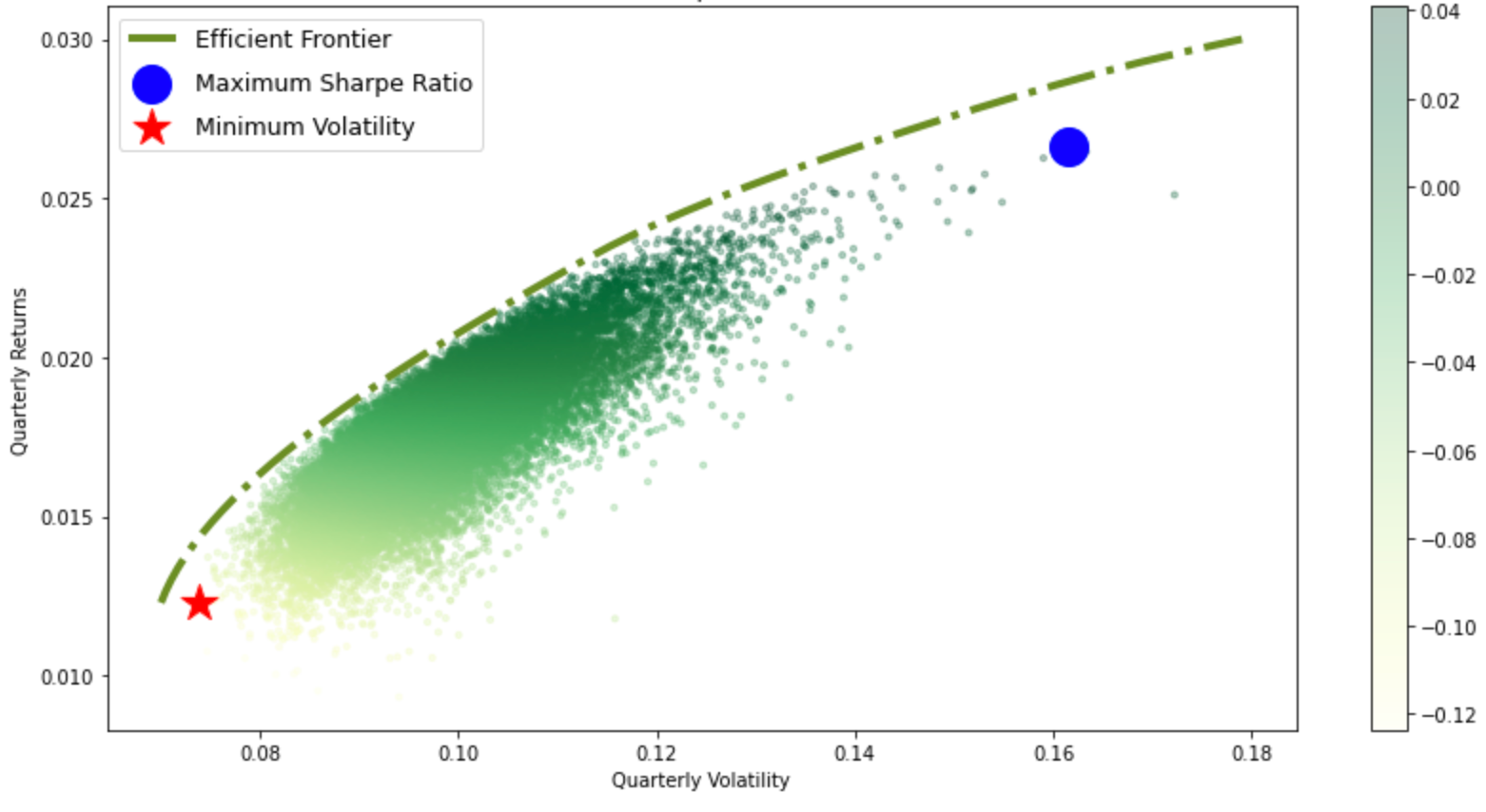

Efficient Frontier

Find efficient portfolio.

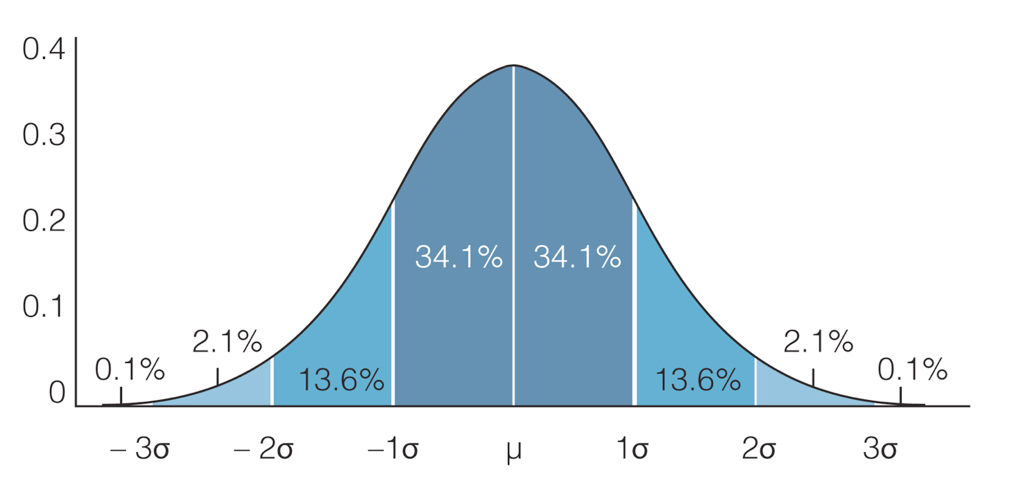

StDev and Correlation

Standard Deviation and Correlation

Portfolio Overview

Overview on portfolio management.

Modern Portfolio Theory

Portfolio management theory.

Portfolio: Using Python

Portfolio management.

Risk-Return Tradeoff

Volatility and return.

EMH

Efficient Market Hypothesis

Sharpe Ratio

An calculation to analyze risk.

Mean, Var., Cov.

Mean, variance, covariance.

Section Five

“De-Fi”

Initial Coin Offering (ICO)

IPO in De-Fi world.

PoW, PoS

Proof of work/stake.

DAO & dAPP

Organizations in De-Fi.

Blockchain

Tech behind De-Fi.

Decentralized Finance

Intro to De-Fi.

Decentralization

Intro to decentralization.

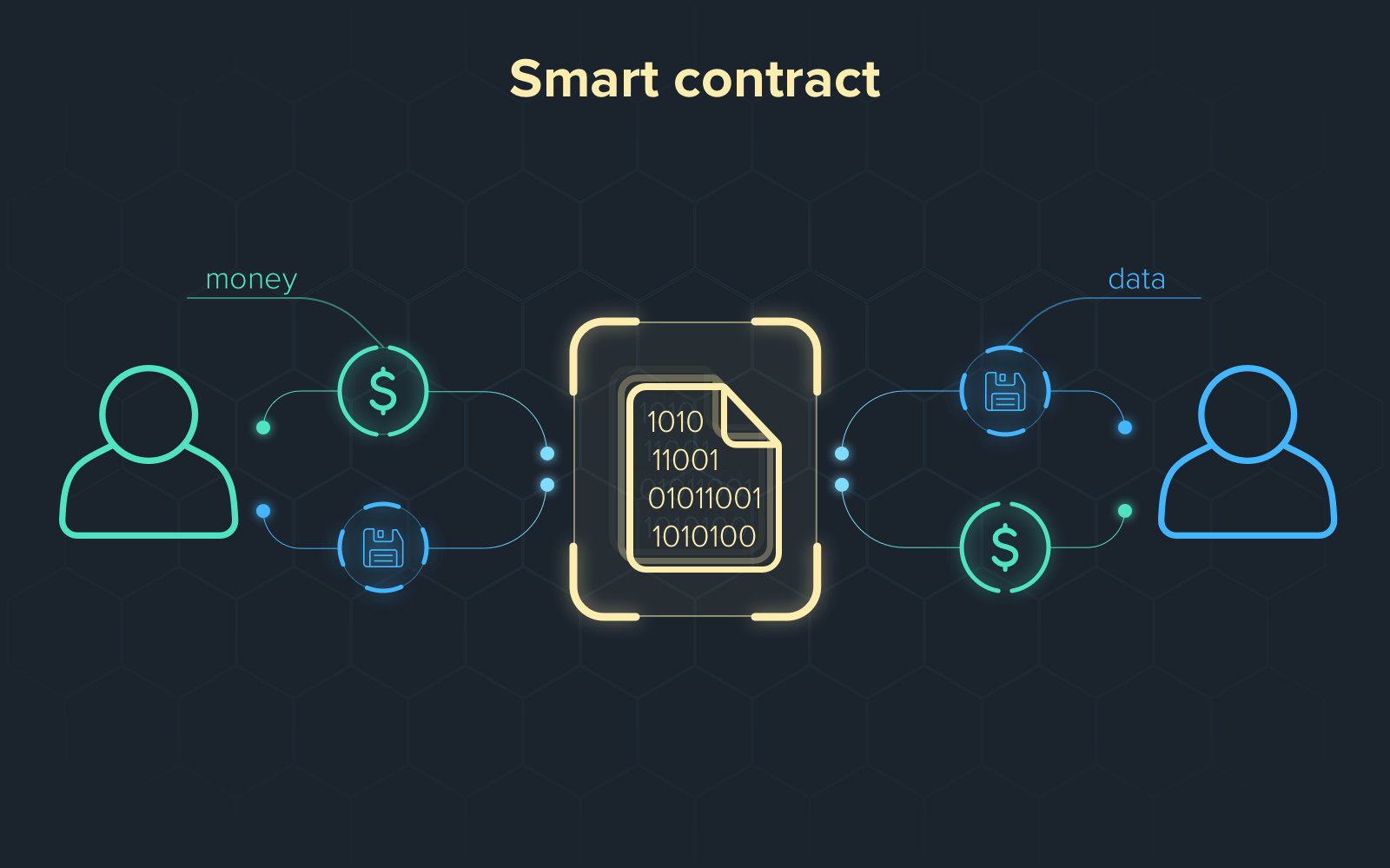

Smart Contract

"Monitor" in De-Fi.

NFT

Non-fungible token.

Cryptocurrency

Part I: Applications of De-Fi

Hash

Secure feature of De-Fi.

Yield Farming

De-Fi trading strategy.

Decentralized Derivatives

Part II: Applications of De-Fi

51% Attack

Potential danger in De-Fi.

Metaverse

Part III: Applications of De-Fi

Section Six

“ESG”

Section Seven

“OTHER”