👾 Game Master

6/21/2022, 3:33:28 PM

ESG Rating

Quantifying ESG Indicators

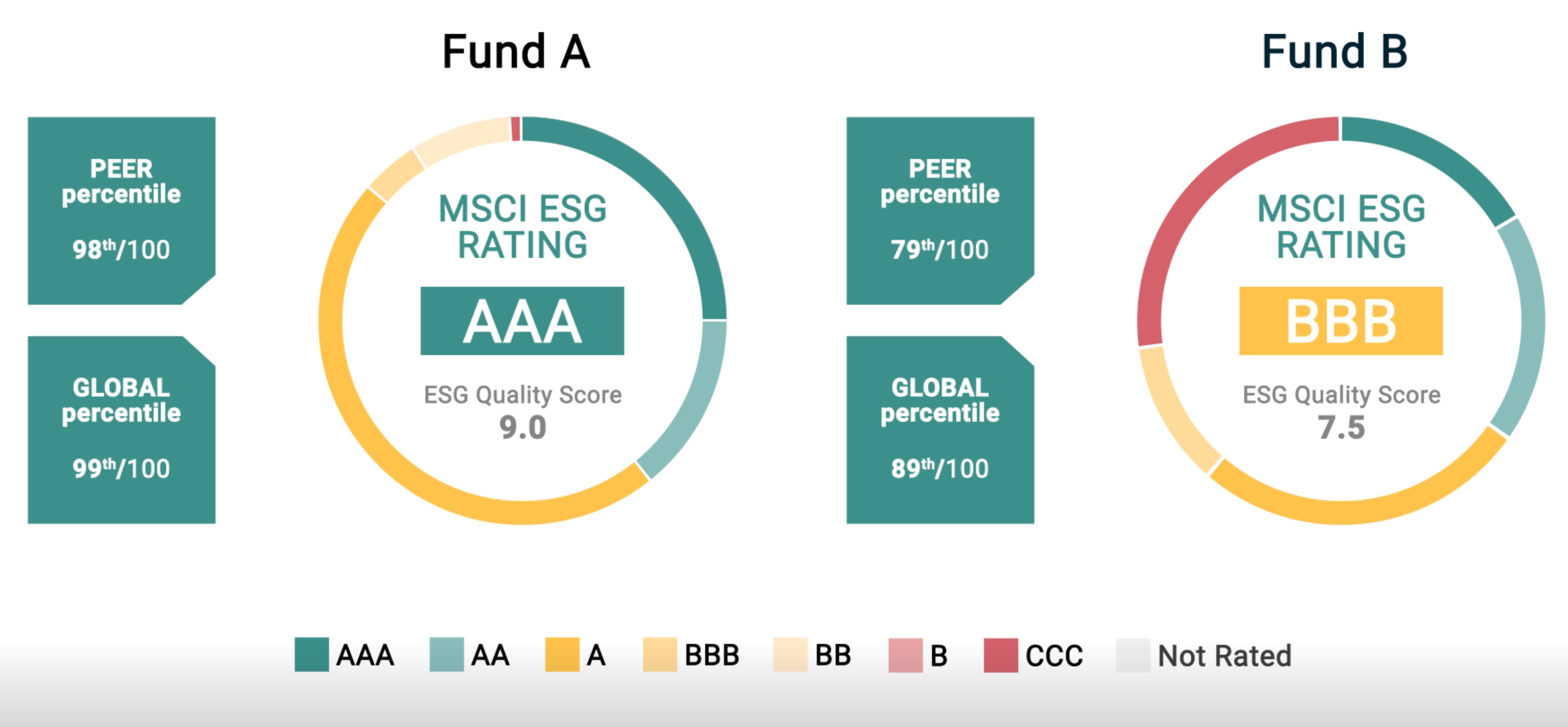

In the article Why ESG Is Important? we discussed the importance of ESG in portfolio construction. However, it is not hard to see that most ESG factors are challenging to quantify. MSCI provides one of the most commonly used ESG fund rating indices [ESG Fund Ratings].

Specifically, they classify assets into A, B, or C. They also assign a value scaled from 0-10 based on the company’s ESG performance.

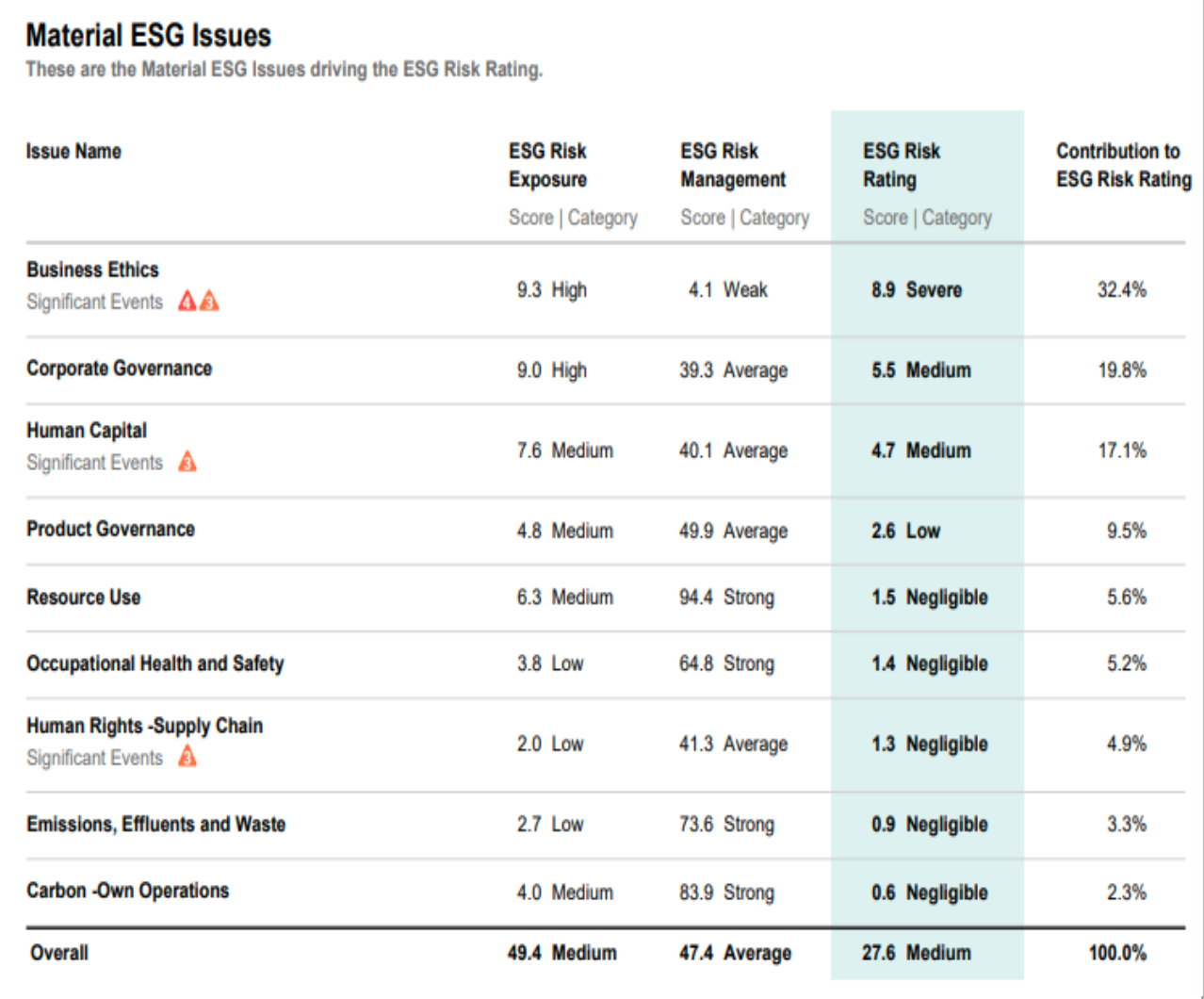

Investors can also construct their own rating system for ESG-related performances. We can categorize some of the most common issues into different sections and rate the companies based on research and analysis.

In the picture shown below, the analyst selected several indicators from each E, S, and G sections. For example, business ethics is under the social category, whereas resource use is under the environmental category. The sum of the score for each category is taken to derive the final score. In this case, the higher the score, the more potential risk for the corresponding category. According to the contribution breakdown, we can see that business ethics has the greatest percentage, which means that this company might have a risk regarding the social section.