👾 Game Master

6/21/2022, 8:32:49 AM

Internal Rate of Return

Definition of IRR

The internal rate of return (IRR) is the discount rate, or compounded return rate, that makes the NPV (Present Value (PV) and Net Present Value (NPV)) equals to 0.

IRR is especially significant in investments such as lending loans. It is essential to remember that the interest rate should be higher than the IRR, in order for the lender to make profits.

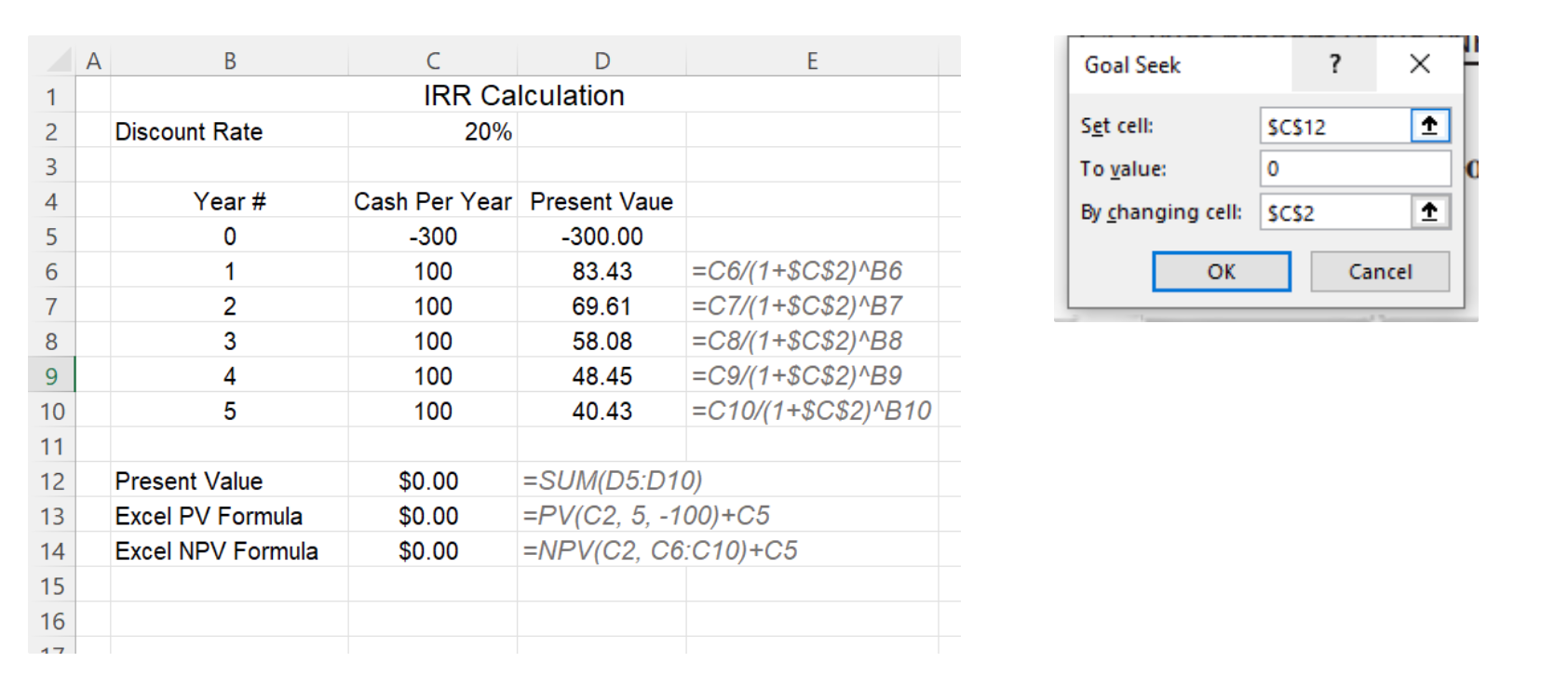

Example: IRR Calculation Using Excel

The calculation of IRR requires finding the discount rate that will make the net present value zero. There are a few ways to do so, including the most fundamental one: trying. However, as advanced investors, there is always a more efficient alternative. The incorporated Goal Seek function in Excel is an effective application. The function can be found in Data → What-If-Analysis → Goal Seek.

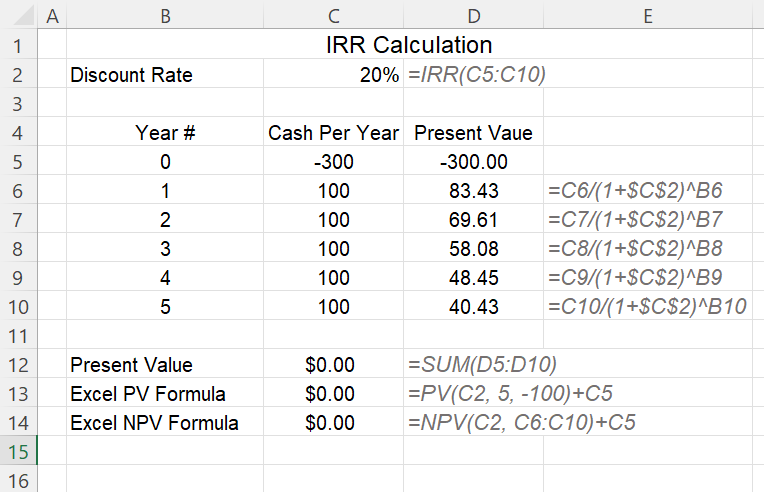

Another way to do so is to use the IRR Function in Excel:

Summary

The bottom line is, that IRR is a crucial link in the application of Time Value of Money, as it measures the needed return rate to make an investment profitable. Understanding the calculation of IRR is thus essential in finance, no matter whether the market is a loan market, bond market, or the stock market.