👾 Game Master

6/21/2022, 12:07:11 PM

Types of Risk

What is Risk?

Risk, sometimes also referred to as volatility, is a key parameter in modern portfolio management. According to the Risk-Return Tradeoff & Volatility, more risks have to be taken in order to yield a higher expected return. For investors with different backgrounds, sentiments, and wealth, their attitudes toward risk vary. The attitudes can often be categorized into one of the three types, which are risk-averse, risk-neutral, and risk-seeking.

Image source: http://go4course.com/Content/app_images/Courses/ca3937eb-a204-42ef-8e44-cd61ff583947.jpg

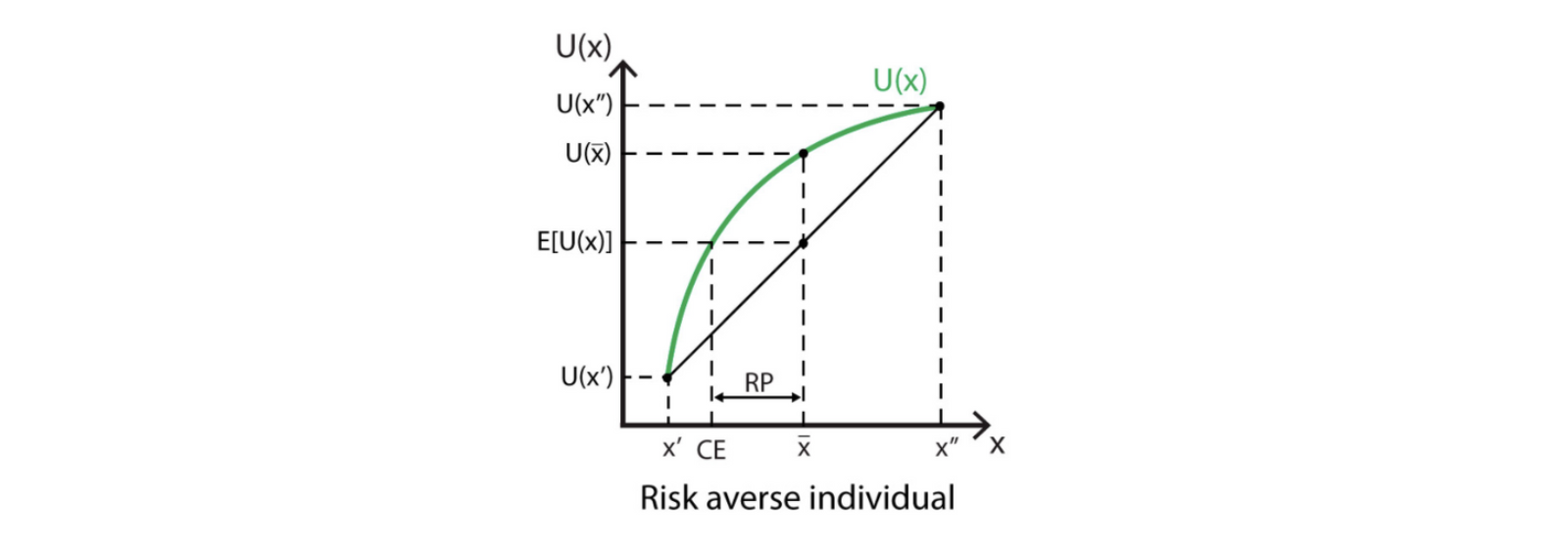

Risk Averse

Risk-averse investors are called conservative investors. They are the investors who are unwilling to afford additional volatility (risk) in their investment portfolio. They often choose to preserve the capital in highly liquid forms so that they can easily withdraw the money when encountering market shocks. These investors usually seek slow but steady growth in money over time. The risk-return tradeoff graph of an risk-averse investor looks like this:

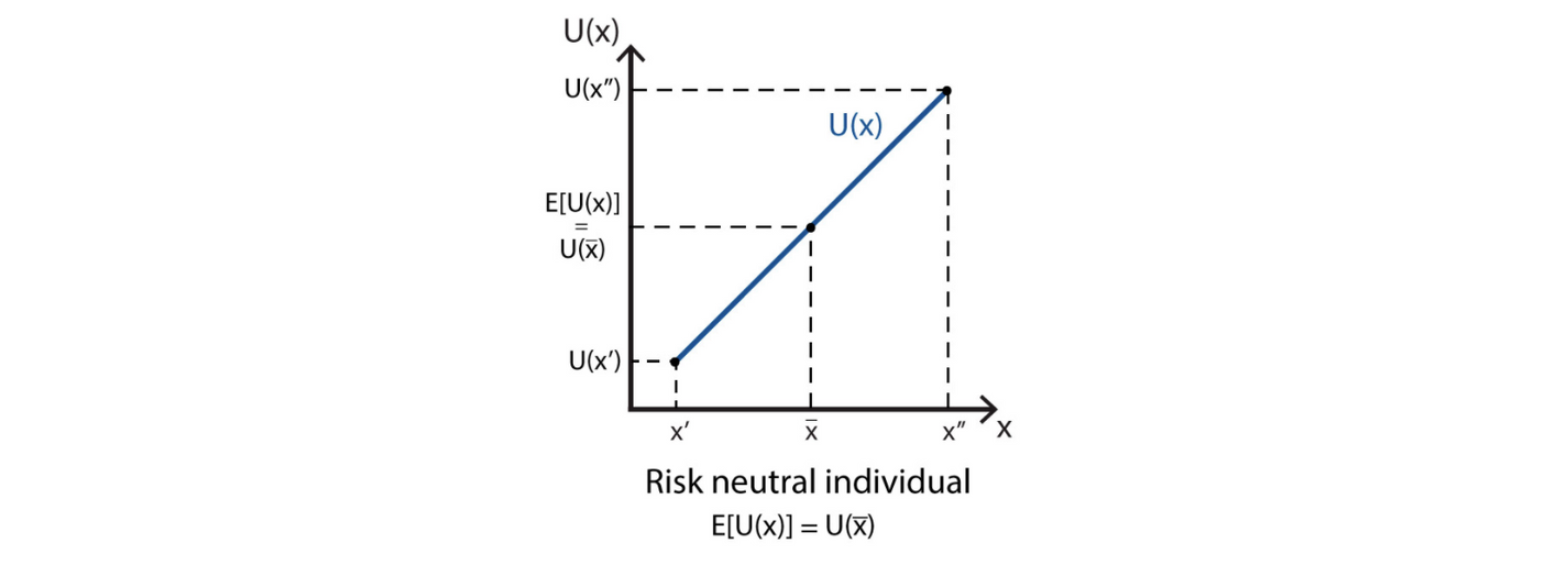

Risk Neutral

A risk-neutral investor is someone who focuses merely on the expected return regardless of risk. Consider two deals, one with a possible loss of $20 and an expected return of $70. The other with a possible loss of $80 and an expected return of $80. A risk-averse investor, who seeks slow but steady growth, would select the first deal. Yet a risk-return investor, who considers only the expected return, will select the second deal since it has a greater expected return. In general, the graph for the risk-turn tradeoff of a risk-neutral investor looks like this:

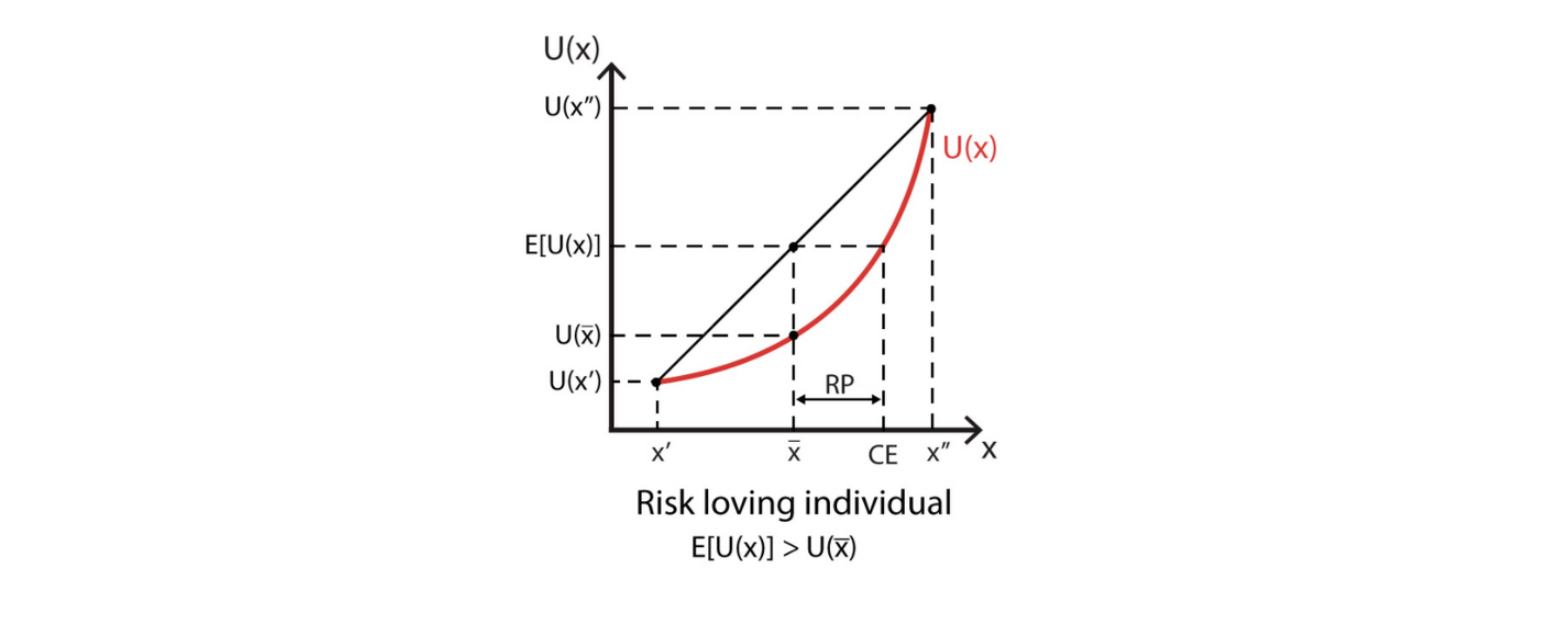

Risk Seeking

A risk-seeking investor is someone who is willing to accept higher risk to gain a higher expected return. They are often interested in speculative, risky investments, such as financial derivatives or venture funds, in order to achieve a high-than-average return. The risk-return tradeoff of a risk-seeking investor looks like this: