👾 Game Master

6/21/2022, 5:50:29 AM

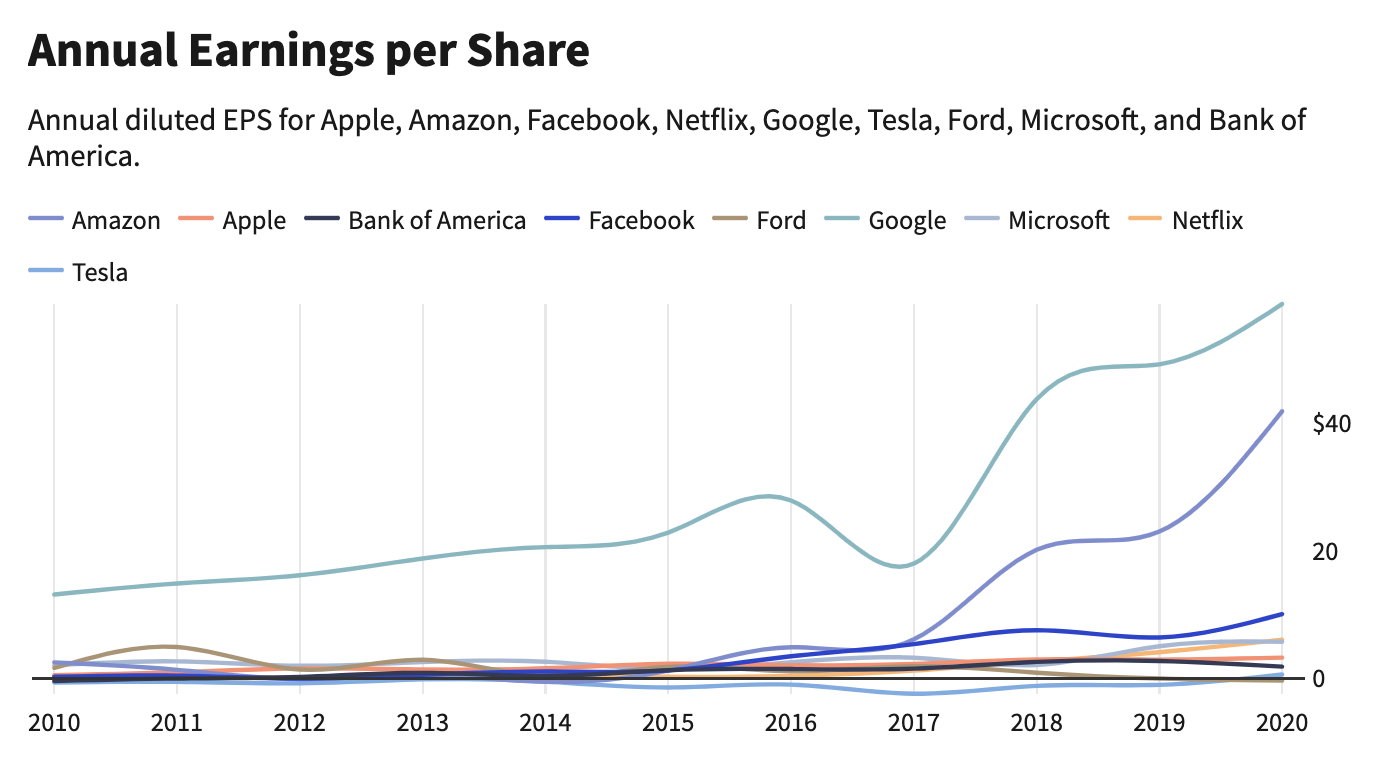

Earnings Per Share (EPS)

Earning per share (EPS) is an indicator of a company's profitability. EPS becomes straight-forward after understanding its formula:

Calculation

EPS = Net Income ÷ Shares Outstanding

Uses

EPS measures a company's profitability. Through the division, investors can see the market's attitude toward the value of the stock, and how much the market is willing to pay for each dollar of the company’s earnings.

EPS is most commonly used as a part of the calculation of the P/E ratio. Here is a brief summary of P/E.

- P/E ratio is a financial metric that evaluates a company. By comparing the stock price with its earnings, the ratio indicates whether the market fairly values the company. Generally speaking, lower P/E means a company is undervalued, and higher P/E means a company is overvalued.

Example:

Here is a comparison between the EPS of various companies. According to the data, we can see that Tesla is having an extraordinary EPS, implying that the company has a relatively larger ratio between net income and shares outstanding. This means that Tesla is having better profitability compared to other companies and that the market wants to pay more for each dollar of the company’s earnings.