👾 Game Master

6/21/2022, 7:36:16 AM

Time Value of Money (TVM)

Quick Definition: What is the Time Value of Money?

The time value of money is the core concept and the foundation for most fundamental approaches in finance. The key definition is that investors prefer money today rather than the same amount of money in the future. An intuitive explanation for this is that money has the potential to grow in value over time, such as making investments, saving in a bank, etc.

Deeper Dig-In: What is the Economic Explanation Behind?

Scenario

Consider the following scenario:

Avril’s parents agreed to give her $1000 as a Christmas gift. At the same time, they offered two choices for Avril to choose -

- Receive the gift immediately on this year’s Christmas.

- Help her keep the dollars and give her $1050 next year.

*Assume that if Avril invests in the stock market, she will get a return of 10%.

As someone who appreciates the time value of money, Avril would choose option one over option two, because if she invests $1000 into the stock market, she will get $1100 at the end of year 2, instead of the $1050 provided by option two.

Opportunity Cost

To understand the time value of money thoroughly, the concept of opportunity cost is also essential to learn. In economics, opportunity cost is the potential return of the best alternative option provides. Therefore, as demonstrated in Avril’s case, the opportunity cost for Avril to take the gift next year is $100, whereas the opportunity cost for Avril to choose the first choice is $50. This derives the same choice for Avril to make.

Accordingly, we now understand the core of the Time Value of Money: money today is worth more than the same amount in the future.

Applications

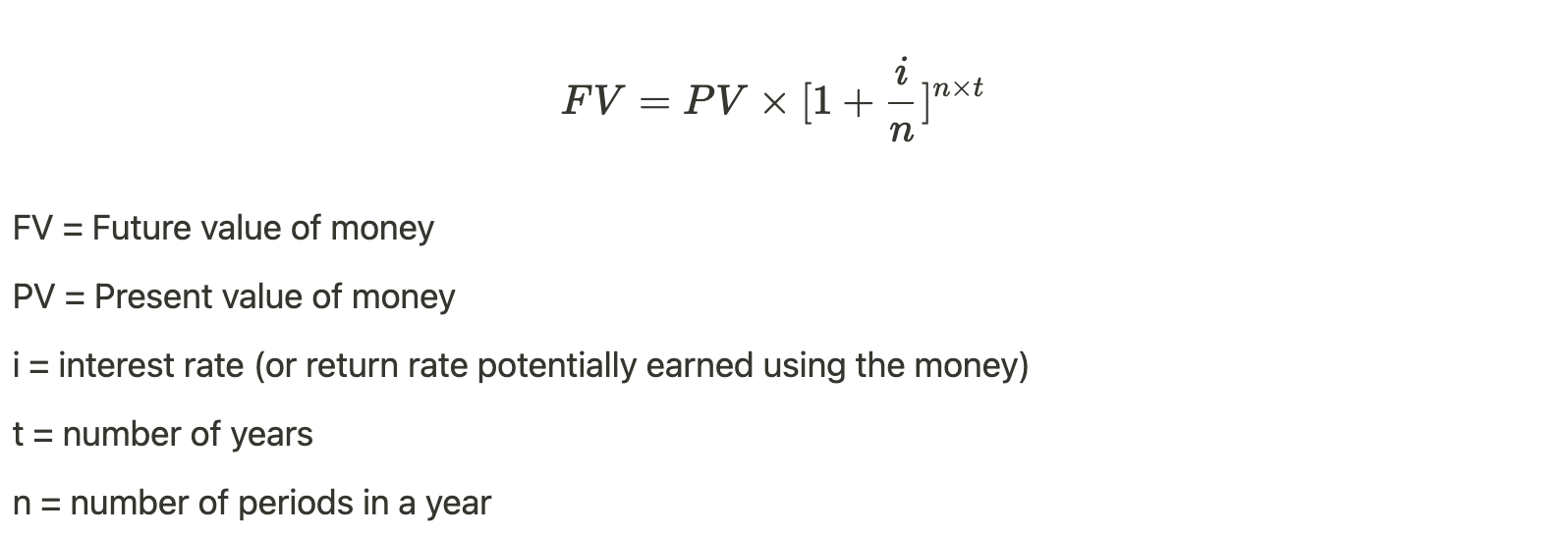

In finance, it is important for investors to quantify the theories and derive an exact value that will help in further analysis and making investment decisions. Based on the time value of money, the future value of the money formula can be derived. The formula resembles the compound interest rate formula.

Calculation

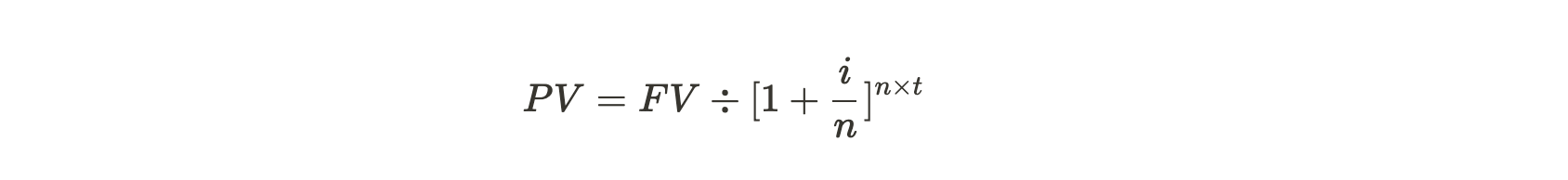

Another expression of the formula is:

This form is critical as it contributes to many models such as the DCF: Using Excel and Gordon’s Dividend Model.