👾 Game Master

3/7/2023, 11:17:42 PM

Industry Cycle

What is Industry Cycle? Why Is It Important?

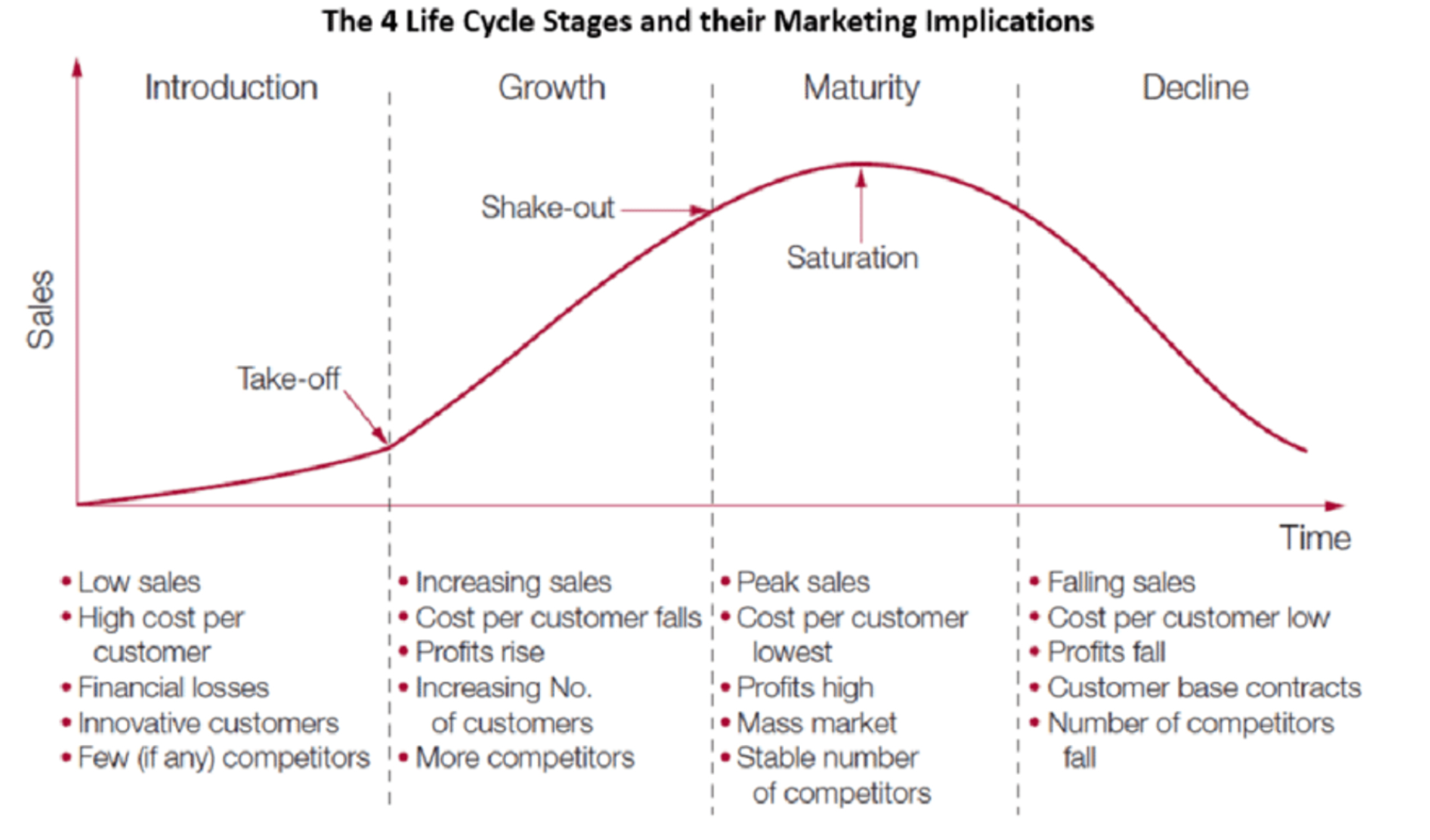

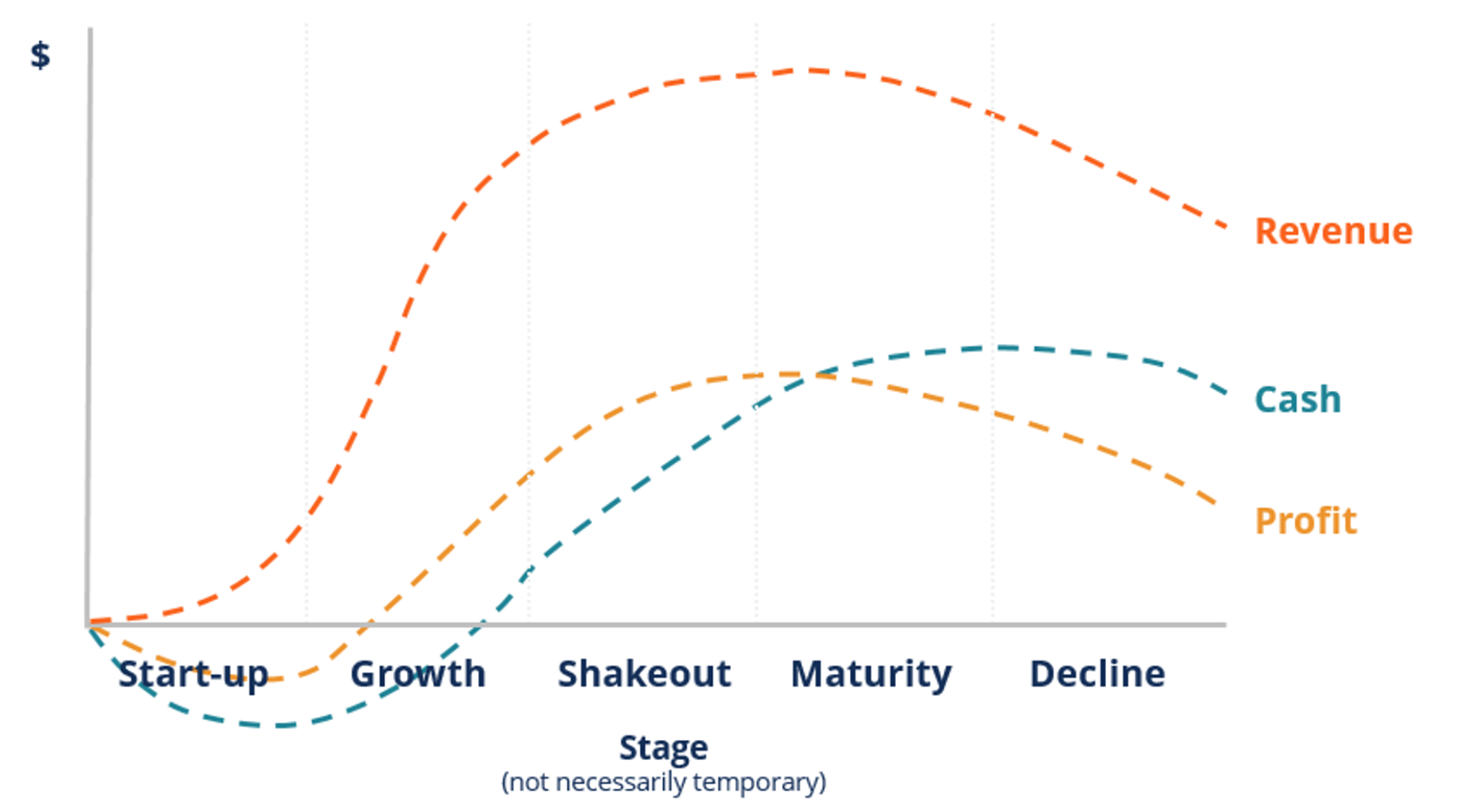

In terms of investing, it is always important for an experienced investor to invest “on trend”, which means good timing. You must have heard the term “buy low sell high.” For example, both investing in Apple, an investment made from Jan 2019 to Jan 2020 achieved a return of approximately 100%, whereas an investment made from Jan 2015 to Jan 2016 made approximately zero return. To select a company at the best time, it is always a good choice to narrow down industry selections. The industry’s timing depends on which phase it is at. There are usually four phases in the life of an industry: introduction, growth, maturity, and decline. The four phases together make the industry life cycle. Investors could make a lot of money by investing in the early stages and selling before the declining stages.

Introduction

This is the time when innovators start to develop new businesses. Everything is unknown in this phase. Some potential investors here are angel investors and some venture fund companies (companies that provide money for start-ups). The introduction phase is the riskiest phase to invest in because of the high uncertainty. Even some of the most experienced investors are not sure if their investment will generate positive returns. In this phase, the industry only has a certain amount of players (businesses).

Investments during the introduction phase follow the principle of “high-risk, high-return“

Growth

This is when the industry starts to form its prototypes. More companies are joining the game, and the structure for the major business in the industry is established. As supply in the industry grows, demand also grows. More customers will choose to purchase products or services offered in this industry. Most venture funds and some other private equity (institutions that invest in private companies) will enter during the early-growth stage. The late-growth phase is the time when most experienced investors enter the game. Theoretically, the growth phase is the most optimal time for knowledgeable and experienced investors to invest.

Maturity

This is when the growth reached its peak. At this time, the business is fully established. Both its supply and demand had grown to their climax. Some companies will be listed as public companies. Competitions between industry players are especially obvious in this phase, as their growth slows down, companies start to focus on gaining more market shares. Usually, a huge amount of investors (and speculators...) will emerge into the industry, rushing to invest their money. The most optimal time to exit the market is at the late maturity phase (i.e. before the decline phase).

Decline

After the peak, it comes the declining phase. The industry is no longer able to support its growth. The decline might be caused by many factors, such as a change in customer tastes (which is frequent in industries like fashion), new policies (often in technology industries, such as semiconductors), economic recession (which will affect all industries, but some industries will be more sensitive toward economical changes). The weaker players will not exist in the industry because they no longer can generate profit. Only some big companies will stay. For an experienced investor, the best choice is to exit the market before the decline phase, or in the early decline phase.

But of course, even for the most experienced investors, it is difficult to find the exact timing. But just as the saying goes, “there is no wave without wind”, there are indeed many indicators that imply the decline of an industry. How sensitive an investor is toward these signals marks how successful the investor can be.

Different Industry Cycles

Depending on the business industry provides, the types of industry cycles vary. Some industry cycles are faster and less stable, whereas others might be longer and more stable. Different investors might be interested in different types, based on their time horizons.

To have a clear idea about the industry cycle, graphs are shown below to depict various industry cycles and their characteristics.