👾 Game Master

6/21/2022, 8:09:15 AM

Beta (β)

What is Beta?

In finance, beta measures the volatility of a stock, which is the risk of a given company relative to the market. According to the risk-return model, higher beta stands for higher risk and higher return, whereas lower beta suggests a lower risk and lower return.

Depending on the context, beta is also referred to as the systematic risk or hedge ratio.

Application of Beta

The market has a beta of 1.0. Stocks with a beta greater than 1.0 suggest higher volatility (understand volatility as fluctuation in prices) with respect to the broader market. Stocks with a beta less than 1.0 suggest lower volatility with respect to the market.

Different to Alpha (α), beta had no “absolute definition,” which means neither a high beta nor a low beta is “absolutely” better. For investors seeking stable and slow returns, a low beta might be preferred. On the other hand, a high beta stock could be selected if an investor is looking for a “high-risk high return” investment.

Calculation

There are two ways to derive beta, depending on how much you want to know, and where you want to apply this tool. I will mention the straightforward method first and the more concise method next.

Method 1: Formula

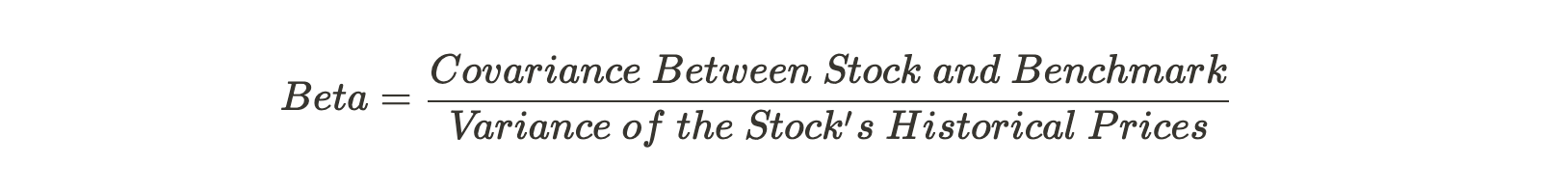

As mentioned, beta is a measurement of volatility. In statistics, two common approaches to measuring volatility are Variance (Link here Mean, Variance and Covariance) (which calculates the fluctuation of a data group itself) and covariance (Link here Mean, Variance and Covariance) (which measures the volatility of a data group with respect to another one). Numerically, beta takes these two approaches in its calculation and suggests the fluctuation of a stock’s price compared with the benchmark:

Method 2: Regression

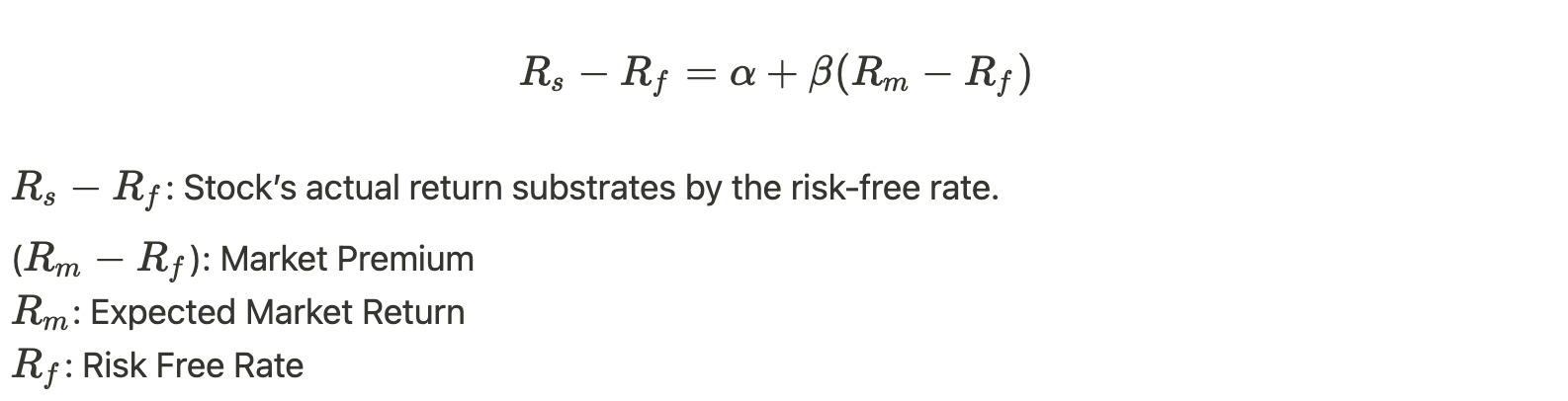

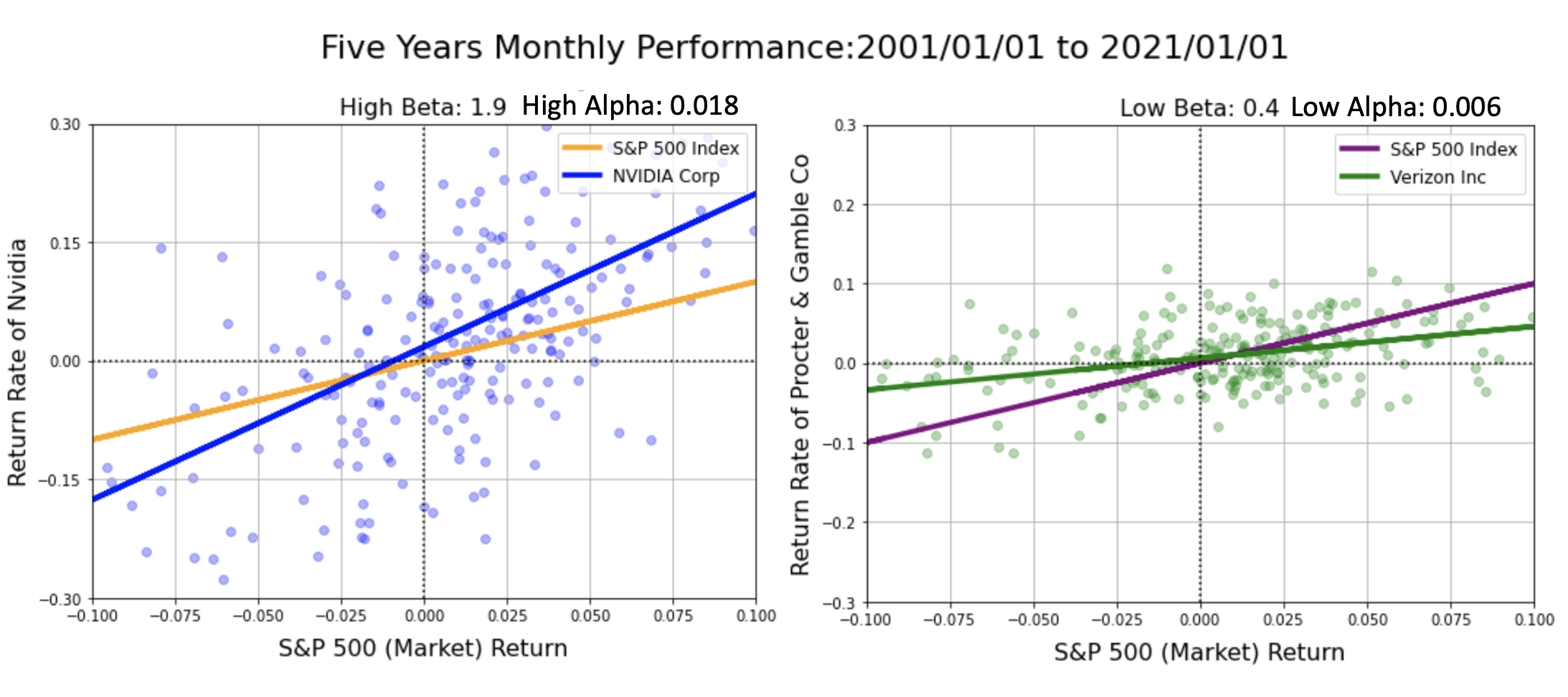

Technically speaking, both Beta and Alpha (α) are derived through regression analysis.

To derive Beta, we need to general a regression model that finds the relation of stock A’s price relative to the benchmark. The slope of the result will be the beta, and the intercept of the result will be the Alpha (α) (the excess return a stock generates with respect to the benchmark).

Application of Beta - the CAPM Model

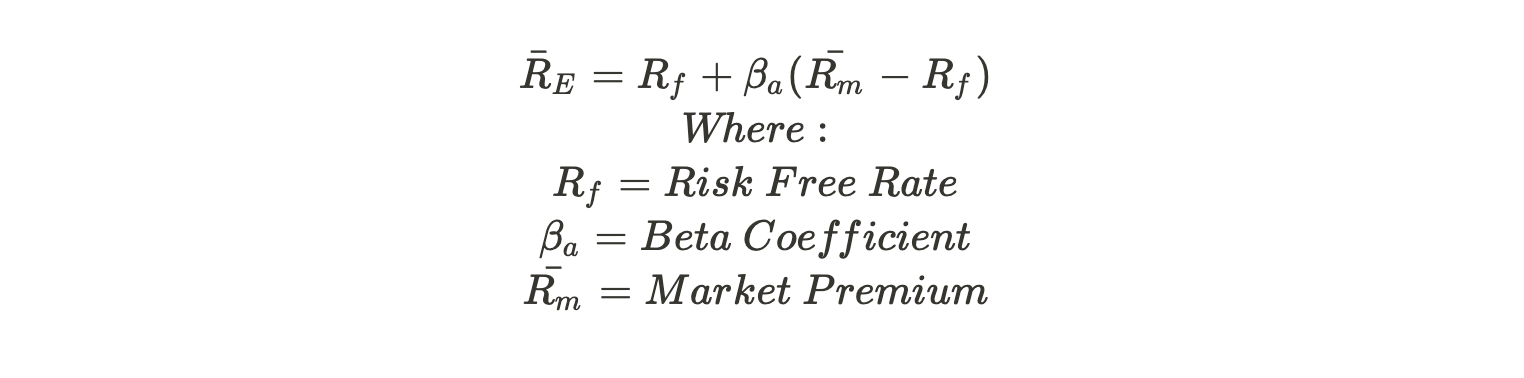

Beta is an important component in the The Capital Asset Pricing Model (CAPM), which models the expected return of a stock. Since beta measures the volatility of a stock relative to the market, by multiplying beta by the market’s expected return and adding back the risk-free rate, an investor could calculate the theoretical rate of return of the selected stock.

To learn more on how CAPM works, read the article: Portfolio Management: Using Python.