👾 Game Master

6/21/2022, 11:53:22 AM

EMH

Understanding From Scratch

All active investors (i.e. investors who hope to increase their return rate by implementing different strategies) pursue the same goal, which is, beating the market/index growth rate (in other words, generating a high Alpha (α)). For years, scholars, financial experts, and the entire Wall Street worked hard in seeking methods that can result in higher alpha. Alpha simply stands for the additional return for a portfolio compared to the benchmark’s return rate. Surprisingly, the Efficient Market Hypothesis (EMH) suggests that all of these methods are invalid and that it is nearly impossible to generate alpha if an investor purely relies on stock selection and purchase timing. The EMH is undoubtedly a critical theory in finance, as it proposed the relationship between risk and return. But what are the details behind the EMH and how does it work in the financial market?

Information About the EMH

The efficient market hypothesis was first introduced by Eugene Fama in his book “Efficient Capital Markets: A Review of Theory and Empirical Work” in 1970.

Picture source: https://research.chicagobooth.edu/-/media/research/famamiller/fama.jpg

According to the hypothesis, it is theoretically impossible for investors to purchase an “undervalued” stock because all stocks are indeed fairly valued and their prices fully reflect their intrinsic (or “real”) value (and yes, this makes fundamental evaluations ineffective). Therefore, from a long-term perspective, both fundamental and technical strategies will fail to consistently outperform the market.

Data were collected by researchers trying to prove the EMH. According to the study, in the past ten years, only 23% of active fund managers were able to beat the passive fund managers. This is an incredible outcome because active fund managers paid way more money for their active management, but they earn less return compared to passive fund managers.

Nevertheless, the EMH was questioned by plenty of investors because of stories of long-period excessive returns, such as those achieved by Warren Buffet. For decades, he was able to consistently outperform the market, providing people with evidence to question the EMH.

The EMH not only provided people with a new perspective of the stock market functionality but also had an important role in many portfolio management models. Since EMH states an efficient market, additional risks must be taken by investors to generate alpha. EMH provides a lens of an “efficient combination” of financial assets classes, from which derives the concept of Efficient Frontier and Efficient Portfolio.

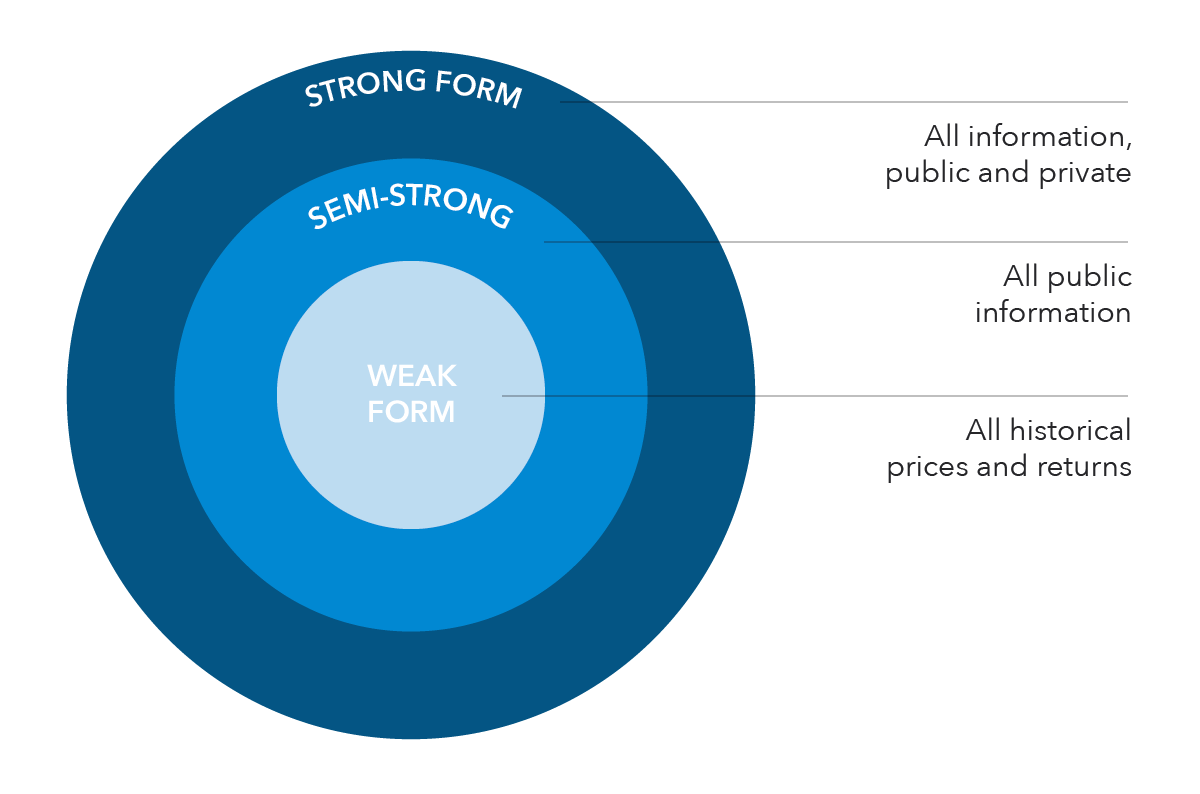

There are three forms of EMH. Weak form: the market price reflects all the information related to the historical prices and returns. Semi-strong form: the market price reflects all the publicly known information. Strong form the market price reflects all information, both private and public.