👾 Game Master

6/21/2022, 11:26:17 AM

Initial Public Offering (IPO)

Introduction

“Public company”, “private company”. These are two familiar terms for most investors. Different from a private company, public companies’ shares (the stocks we purchase) and bonds can be publicly traded, which is the main source of funds they gain. On the other hand, private companies rely on private investors or venture capitalists to acquire funds. Public companies also need to regularly reveal the details of their business to the public according to the SEC. A question that comes to new investors’ minds is: What is the process of turning a private company public? And, why can we buy shares from companies such as Apple, Tesla, or Facebook? Well, the answer is that companies like Apple are public companies, and they became public through the process of IPO (initial price offering).

Picture source: https://www.gfmag.com/magazine/october-2020/alternative-ipos

Process of IPO

Before going through IPO, companies are considered private companies. As a private company, it has relatively small but close investors. The main sources of investors in this stage could be family, friends, or professional investors such as venture capitalists (VC). An advantage for a private company is that it is not required to reveal all of its internal business processes. Being a private company makes the management and operation simple.

When a private company eventually gained stable and solid fundamentals (typically when reaching a valuation of $1 billion, AKA a unicorn status), it is qualified to be listed and go public. Yet, many currently listed stocks did not fulfill this standard (in fact plenty of the companies on NASDAQ didn’t reach this standard), therefore this is a standard but not a must-fulfilled condition. Then, if the company is willing to go public and IPO-ready, it can go through the IPO process.

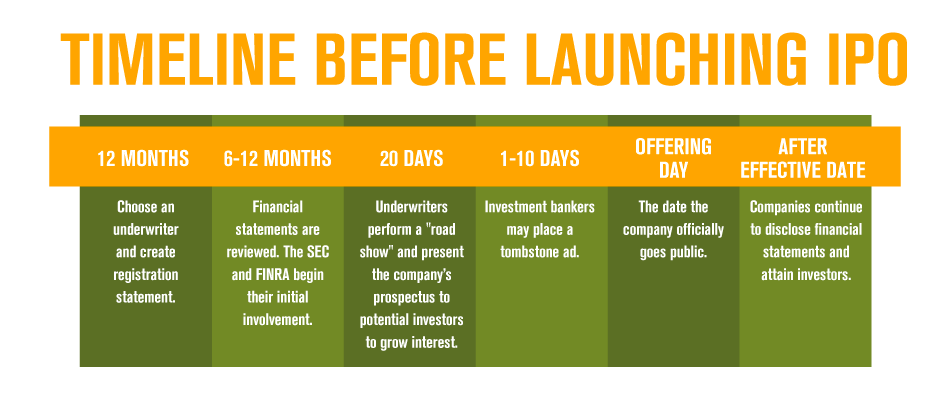

IPO is a big step in the growth of a company, as it represents a huge step forward and an opportunity for expansion. But at the same time, transparency is expected to increase to meet the credibility requirement. The process of IPO is often supervised by the Securities and Exchange Commission (SEC) to make sure it is credible, unbiased, and transparent.

The value and share prices of the company are both defined by the companies, their underwriters, and the investors during their roadshows (which is a series of meetings during the IPO for the companies to talk with their potential investors). After going public, the private shares of the company will also turn public and can be traded according to its share prices. Listed as a public company means a huge opportunity for millions of investors to purchase the shares, providing capital to the company.

Graph source: https://online.pointpark.edu/wp-content/uploads/2021/02/IPO-Process-Timeline-Point-Park-Online.png

Staying Private

Despite the intriguing funding sources that IPO brings, many famous and profitable companies in the world still choose to stay private. Huawei, the technology giant in China, is one of the members of private companies. In short, Huawei is supported by the Chinese government and has a solid customer base across the globe. Therefore, the company does not need additional capital from the stock market. Besides, going public means a more complicated process of supervision to reach transparency. As one of China’s most essential technology companies, transparency is certainly an issue to consider. Therefore, instead of putting effort into IPO, Huawei’s strategy is to focus on the product development and business operations.