👾 Game Master

6/21/2022, 3:04:57 PM

Decentralized Finance

What is Decentralized Finance?

The universe of finance is always evolving, and it is essential to always keep updated on what is going on in the finance world. Although the economic concept Decentralization is not a new phrase, it developed a complete system in recent years and had gained lots of attention, which is the so-called De-Fi system.

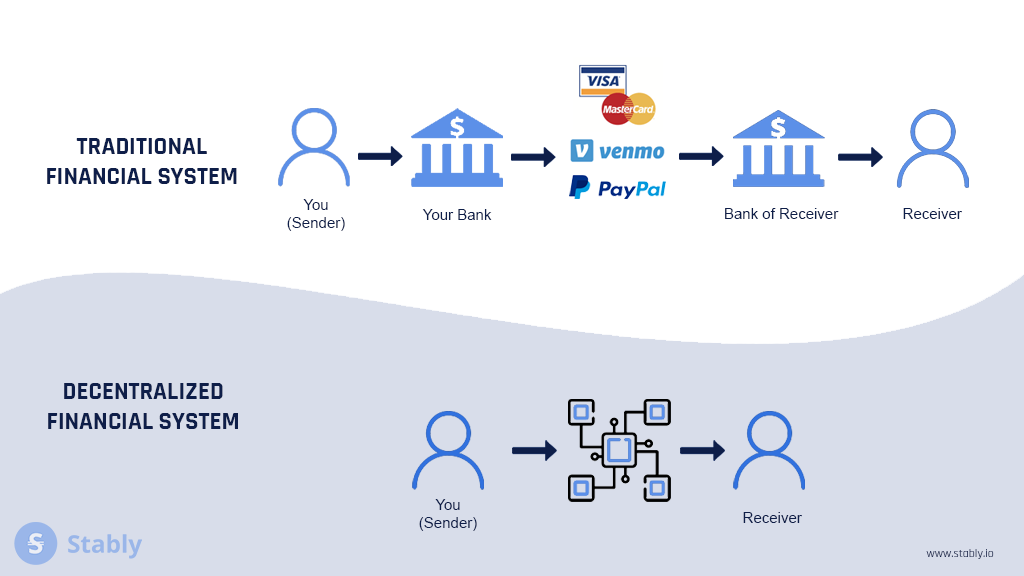

Decentralized finance (De-Fi), is a system in which financial products (such as stocks, bonds, etc) are available to trade on the decentralized blockchain. Instead of having a central government or financial intermediary facilitating the transactions, by applying De-Fi, different parties can trade directly with one another.

In the current world, technology is applied almost in all financial institutions. However, in most cases, technology only assists the transaction to happen, and there are often other legislations and standards to regulate the market. Some examples are Visa cards, Venmo, or PayPal. They are new technologies, yet, they are still controlled by a bank, an institution, or a company.

De-Fi stands out because it makes technology itself the core and the media to complete and supervise transactions. Technologies no longer facilitate a certain centralized institution. The technology works for the entire system.

Application of De-Fi

Most of the common financial products can be applied to De-Fi. This article provides you with two of the most popular applications of De-Fi. To learn more about other interesting applications of De-Fi, check out the De-Fi application section.

1. Lending and Borrowing

The financial market is developing vastly. It is now shifting towards a model where users can control the market, instead of letting the bankers and central authorities rule it. With the application of blockchain, peer-to-peer lending and borrowing are achieved and bring customers new experiences. Borrowers can make a loan through decentralized platforms, called P2P lending.

When we think of lending and borrowing, most of us will imagine a scene in a bank, with a banker dealing with tons of documents that are related to our trust system. The process is sophisticated, usually takes days, even weeks, for the borrower to receive the loan. Sometimes there might be the case that the borrowing application is rejected by the bank. All of these scenarios sound familiar but make people feel a headache.

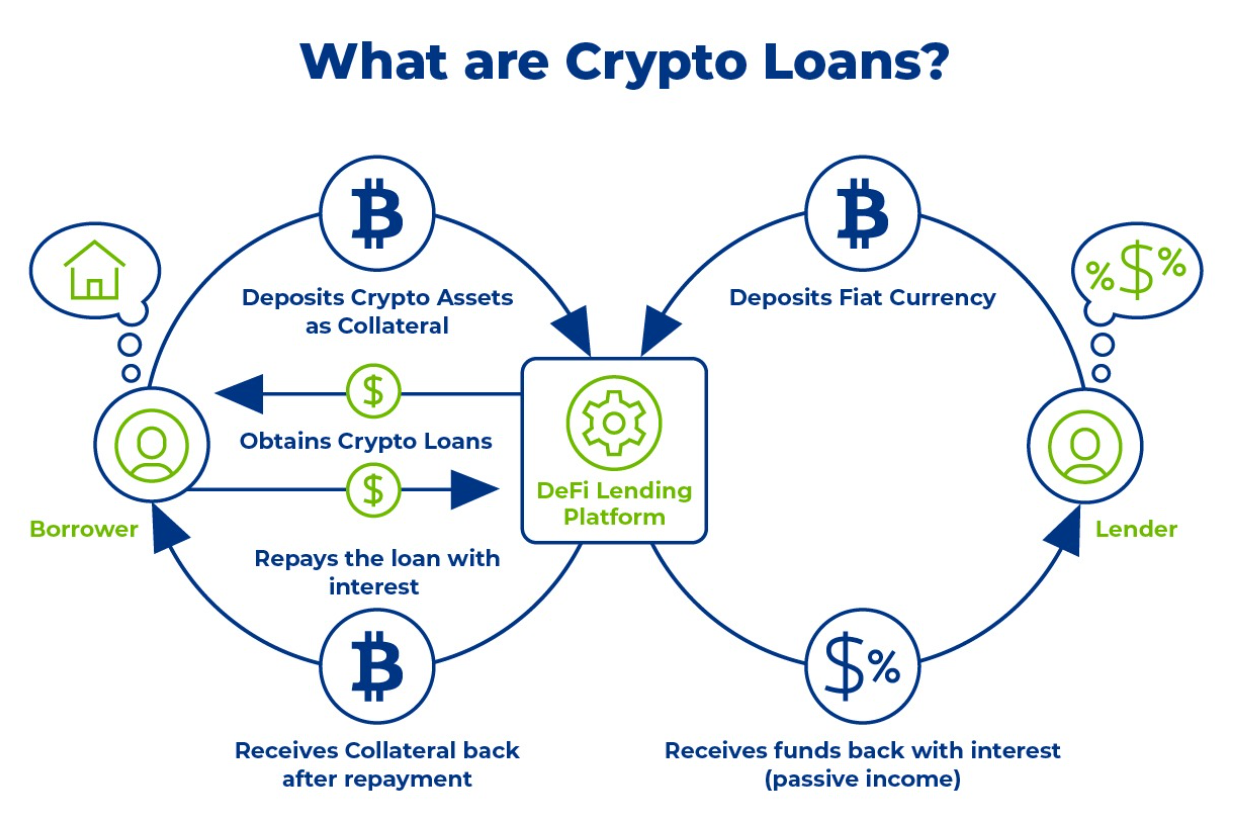

By applying De-Fi, users can go through the lending process without the presence of a centralized institution (i.e. the bank). Instead, users only need to go on a decentralized lending platform and make a deal. For lenders, they can pool their assets into the so-called "lending pool", and the assets will be automatically distributed to borrowers through smart contracts.

Image source: https://cryptodeadline.com/wp-content/uploads/2021/07/5fc0bab9c53fa0ccdf334f42_Blog_CryptoLoans_25.jpg

The function of a De-Fi lending system is similar to traditional lending. The lenders can earn interest, and the borrowers need to charge interest together with the borrowed money. The only difference is that there isn't a need for a middleman, because a Smart Contract will set up everything properly to manage the deal.

A smart contract is a self-executive, programmable contract that can automatically supervise the deal. By utilizing a smart contract, supervising fees, lawyer fees, and other costs are reduced from the process. This increases the efficiency of the lending process, decreasing the cost for borrowers, and reducing the risk for lenders to take.