👾 Game Master

6/21/2022, 6:01:11 AM

Enterprise Value (EV)

What is Enterprise Value (EV)?

Enterprise value (EV) is a measurement of a company's net worth. It is similar to market capitalization meanwhile taking liabilities into consideration. It is a handy metric when evaluating a company for potential M&A (Merger and Acquisition) because it diminishes the uncertainties brought by debt.

Difference With Market Capitalization

When considering a public company's value, many investors use market capitalization as an indicator. However, market capitalization leaves out many important factors, such as operating liabilities that need to pay, and extra operating assets reserved. Therefore, enterprise value is sometimes also viewed as the adjusted market capitalization, as it takes operating assets and operating liabilities into the determination of a company's value.

Difference With Equity Value

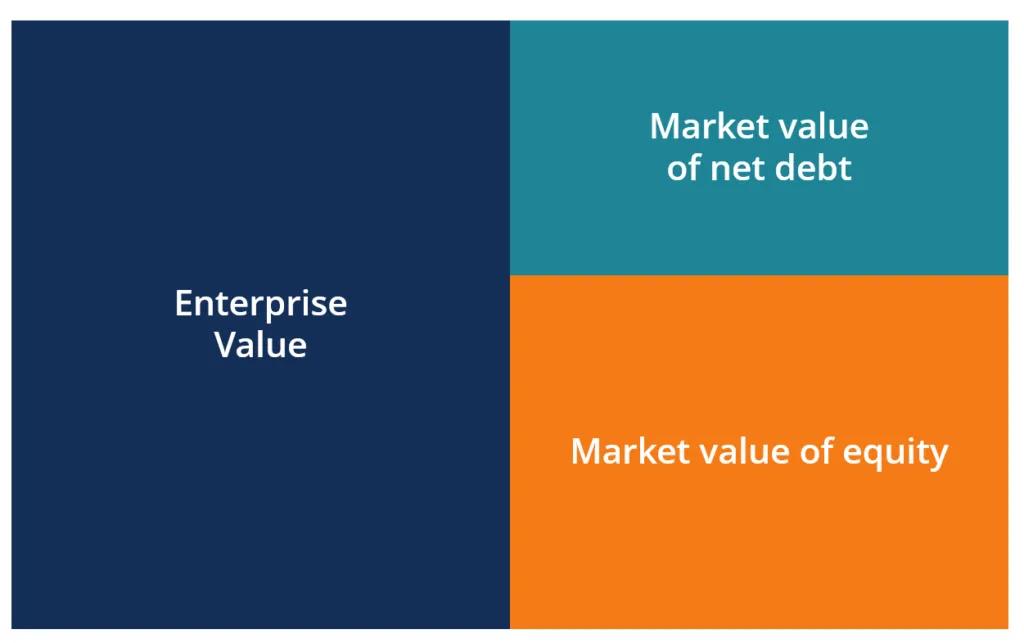

Another similar metric to measure a company’s value is equity value. Equity value can be used in both public and private companies. Specifically, equity value takes into consideration all types of debt, including the one that is excluded in enterprise value. For private companies, equity value act a similar role as market capitalization. The difference between enterprise value and equity value can be shown in the formula:

- Enterprise Value =Operating Asset-Operating Liabilities Enterprise\ Value-Net Debt=Equity Value

Conclusion

In conclusion, EV reveals to the investors the net worth of a company. It shares some similarities and various differences with market capitalization and equity value. All three valuation metrics are important, and they provide three different perspectives of viewing a company’s value.