👾 Game Master

6/21/2022, 7:52:37 AM

Weighted Average Cost of Capital (WACC)

Definition of WACC

The weighted average cost of capital (WACC), as its name suggests, is the expected rate for a company to pay in order to secure all sources of its assets. Therefore, WACC suggests the rate that a company must earn to satisfy its sources of finance (i.e. lender, investor, creditor, shareholder, ...). From another perspective, WACC also implies the investor’s opportunity cost of taking the risk to invest money in a specific stock. Based on its definitions, WACC is frequently used in the discounted cash flow model because it behaves at the discount rate for a company’s future free cash flow. This is briefly mentioned in the following text, and click here to read a detailed article on this model: DCF: Using Excel.

Breakdown & Calculation

As the balance sheet of a company suggests, there are two sources of assets: debt and equity. These two categories further break down into more detailed sources of financing, such as exchangeable debt, common stocks, preferred stocks, and convertible debt. To gain these assets, the company is expected to take some “costs”, and the costs vary according to the sources they belong to (debt or equity).

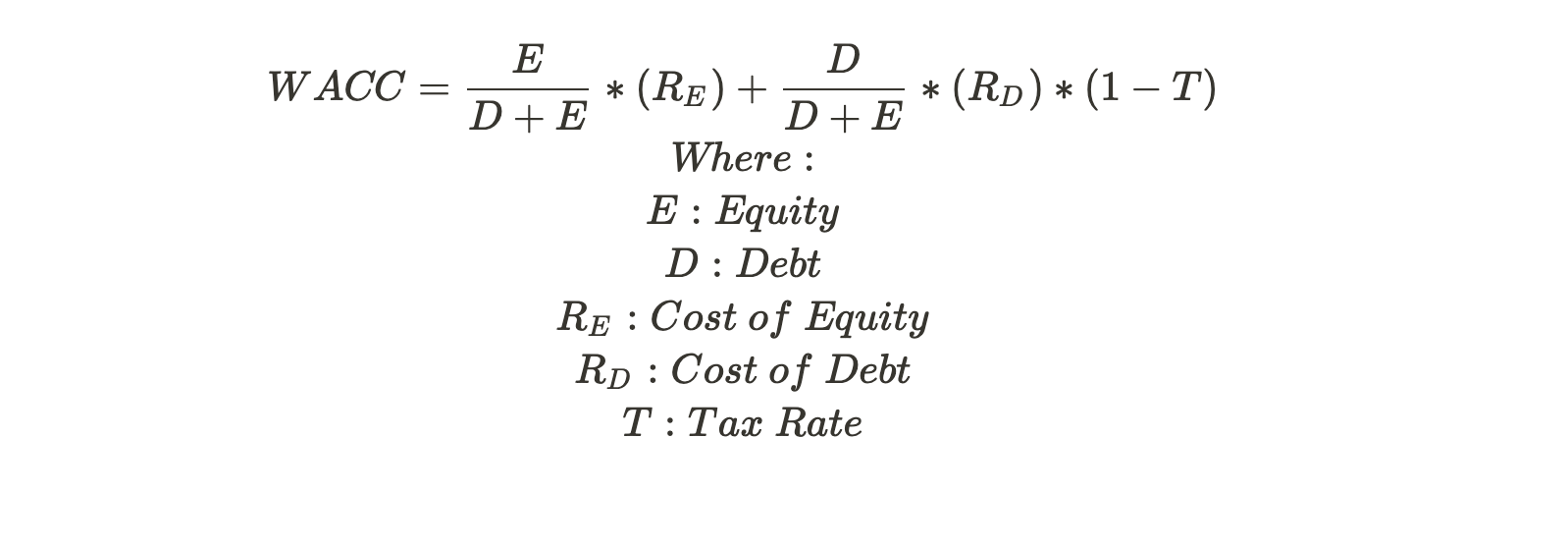

WACC measures the costs of equity and debt and weights their percentages to the total asset. Here is a general formula for WACC.

Equity

Equity, by definition, is the fund the company has through investments from its investors. It is calculated according to the formula below:

- Equity Value (Market Cap) = Shares Outstanding * Share Price

Cost of Equity

The cost of equity can be calculated based on two methods. Both methods work under different scenarios and are based on different understandings of the cost of equity.

Method 1: Gordon Model (Also Called The Dividend Capitalization Model)

This method derives the cost of equity from the following perspective:

In general, to attract more investors, many companies decided to release a certain amount of dividends to reward their shareholders. The dividends are considered the cost equity because it is the cost required to pay by the companies to gain investments. It is also an opportunity cost for investors if they choose to invest in another stock instead. According to this belief, the current price of a company’s stock is worth the sum of all future anticipated dividends discounted at the risk-adjusted cost of equity (R_E).

Gordon Model is first introduced by M. J. Gordan in a paper entitled “Dividends, Earnings and Stock Prices,” Review of Economics and Statistics. If you are interested in the original paper, check this link: https://doi.org/10.2307/1927792.

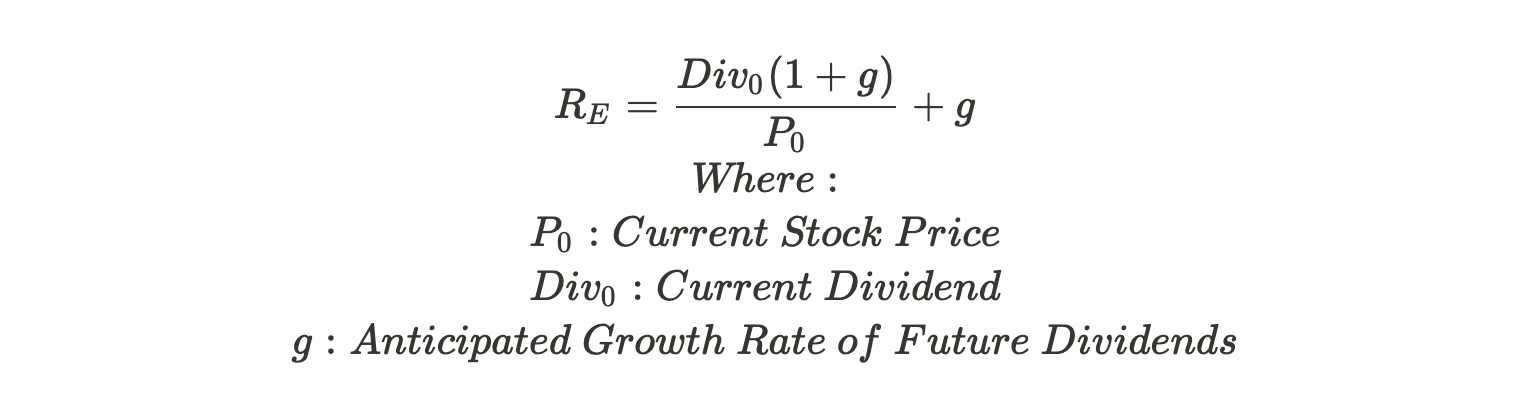

According to Gordon Model, the formula for $R_E$, the cost of equity, is as followed:

Method 2: CAPM Model

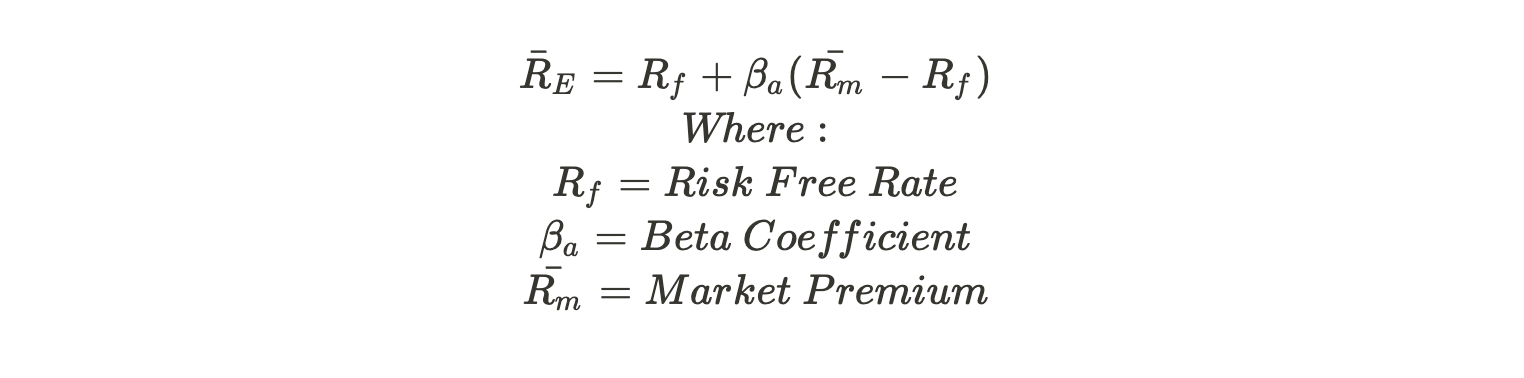

However, many growth stocks (Tesla, for example) usually pay no dividend, limiting the functions of the Gordon Model. The reason is that they generally prefer to reinvest their retained profit in Research and Development to push their future business forward. Therefore, an alternative to the Gordon Model is the CAPM Model. CAPM Model is also the most widely used model for the cost of equity calculation, due to its accuracy (theoretical validity) and simplicity.

CAPM measures the expected return of a certain stock. This implies the return that the market (or most investors) expect to gain from buying this stock. From another perspective, this indicates the cost a company needs to pay in order to fulfill most investors’ expectations.

Debt

Debt, by definition, is the money the company owes. It is calculated by the formula below:

- Net Debt = Total Debt - Liquid Assets (Cash, Cash Equivalents, Marketable Securities)

Cost of Debt

In simple, to borrow money, the company is required to pay a certain amount of interest. The interest that the company pays is a source of cost for debt. Cost of debt (Rd) measures the marginal cost (cost of borrowing an additional dollar) of a company.

A simple method to calculate the cost of debt is:

- Rd = Current Year's Net Interest Paid ÷ Average Net Debt Over This and the Previous Year

A variation of this method is:

- Rd = (Interest Paid - Interest Earned) ÷ (Debt - Cash)

Tax Rate

- Tax Rate = Earning Tax Expense ÷ Earning Before Tax

The reason to multiply the debt section in WACC by (1-T) is due to the tax shield, which is an allowed deduction of tax for corporations. Since taking debt creates a tax shield, investors need to add back the tax shield to reduce the bias. To do so, investors should add back the original expense (in this case the debt) multiplied by (1-Tax Rate).

Applications

The most common application of WACC is to behave as the discount rate in the discounted cash flow model. The discounted cash flow model (DCF model) suggests that a company’s intrinsic value is implied in the sum of all future free cash flows discounted at WACC.

As mentioned above, WACC is the minimal rate that a company must earn to satisfy its sources of finances. Therefore, it acts as the discount rate for all future free cash flows.