👾 Game Master

3/7/2023, 11:45:57 PM

Sharpe Ratio

What is the Sharpe Ratio

The Sharpe ratio was proposed by Nobel laureate William Sharpe and is an often-used ratio by investors to derive the most optimal investment portfolio. The ratio measures the risk-return relationship of a portfolio and represents the average return earned by taking one excess unit of volatility (risk). A maximized Sharpe ratio is sought by investors because it outputs portfolios with the maximum return given risk and the minimum risk is given a return. These portfolios are also called efficient portfolios.

William Sharpe. Photo source: https://www.nobelprize.org/images/sharpe-13422-content-portrait-mobile-tiny.jpg

Calculation

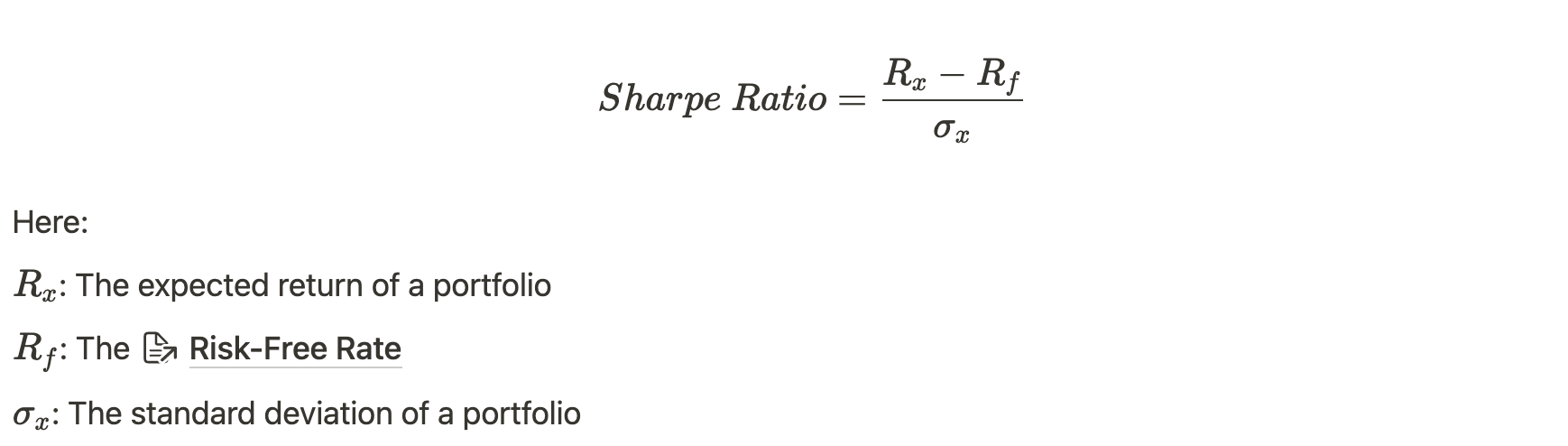

The calculation of the Sharpe ratio is based on the belief that the investment returns are normally distributed. The calculation is another form of the formula for standardized scores (like z-score) in statistics.

The calculation for Rx and R_f can be found in the article Efficient Frontier and Efficient Portfolio.

Application

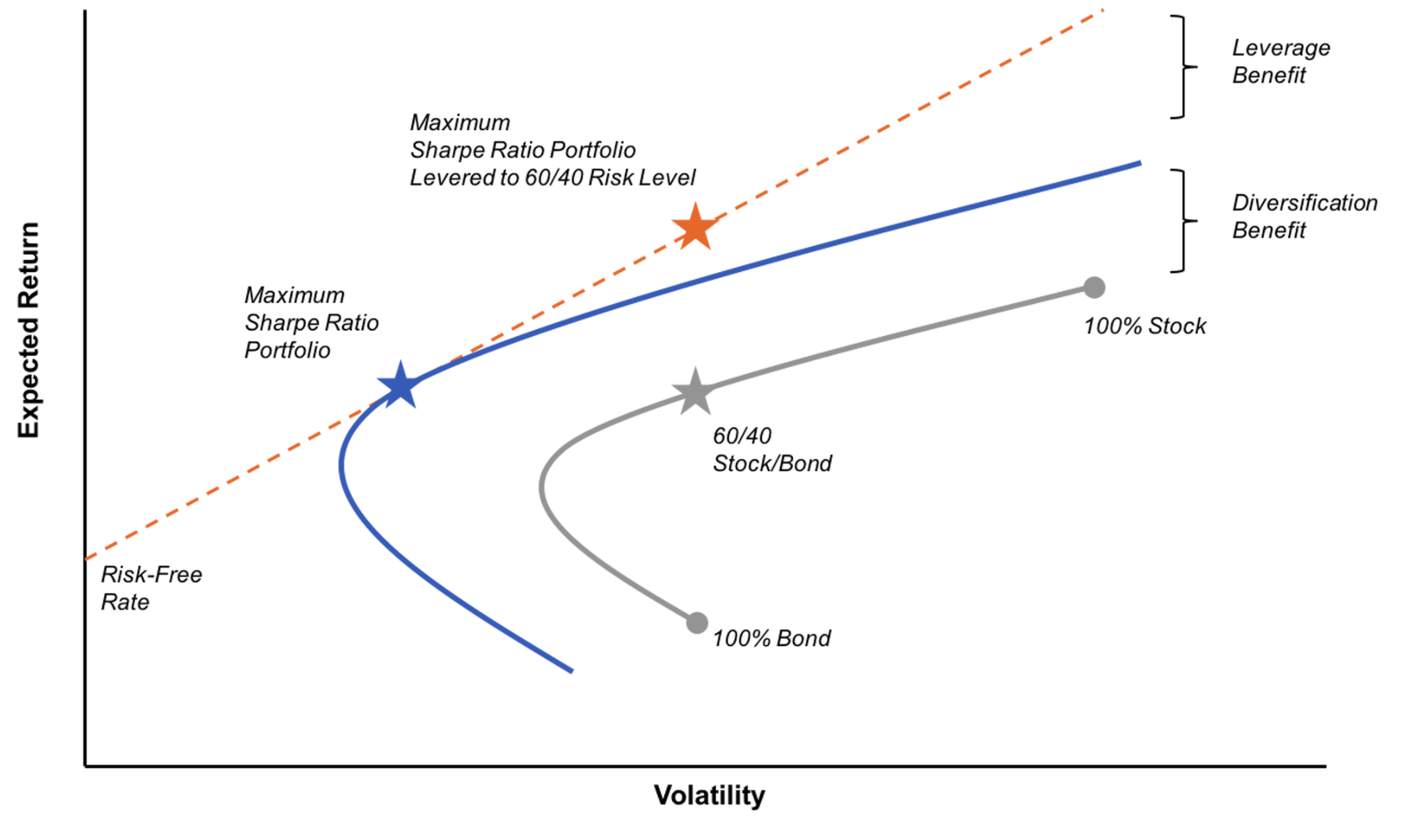

One of the common applications of the Sharpe ratio is to find the Efficient Frontier and Efficient Portfolio. The greater the Sharpe ratio for a portfolio, the better its risk-adjusted return. The Sharpe ratio explains to investors whether the high expected return for a portfolio is due to the high excess risk or due to good investment decisions. If one portfolio has a higher Sharpe ratio compared to its peers, it means that this portfolio combination is a more optimal choice, since the same risk can yield a greater return.