👾 Game Master

5/7/2023, 1:27:07 AM

Ask Bid Order Book

An order book is a list of buy and sell orders for a stock. Think of it like a menu at a restaurant — it shows investors all the different prices and quantities people are willing to buy or sell a stock at.

Structure of Order Book

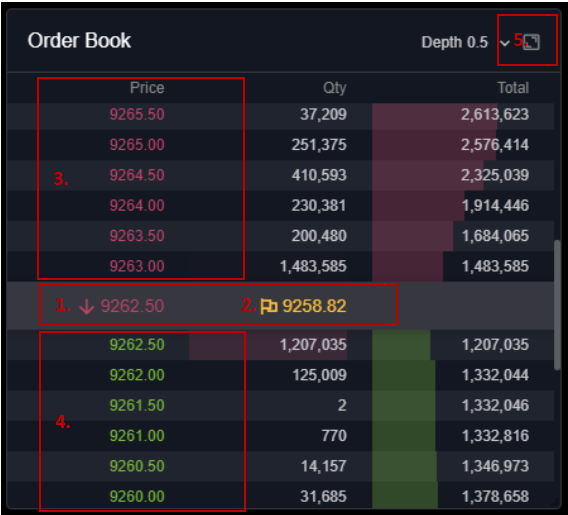

There are two important prices in the order book, which are the ask price and the bid price. The ask price is the lowest price someone is willing to sell a stock for. The bid price is the highest price someone is willing to pay. The difference between the ask and bid prices is called the bid-ask spread.

Graph Source: https://en.wikipedia.org/wiki/Order_book#/media/File:Order_book_depth_chart.gif

When you want to buy a stock, you'll place an order with your broker (which you can practice and experience with Aspect in your dashboard!). You'll specify the price you're willing to pay, which becomes your bid price. If someone in the order book is willing to sell the stock at your bid price, you'll buy the stock from them. Your order will go through, and the trade will be recorded in your portfolio.

Conversely, when you want to sell a stock, you'll specify the minimum price you're willing to accept, which becomes your ask price. If someone in the order book is willing to buy the stock at the ask price, you'll sell the stock to them.

Usually, only a segment of the order book would be revealed. In Aspect market game, for instance, the five-step order book is shown for all companies. Five-step means that only the five buy orders and five sell orders with prices closest to the equilibrium price are shown. These orders are more likely to be accepted by the buyers and sellers from the economic perspective (because sellers are always willing to sell higher, but buyers are always willing to buy lower... this will end up close to the equilibrium).

Image source: https://learn.bybit.com/trading/order-book-explained-for-beginners/

Why is Order Book Important?

The order book is important because it helps investors and traders make informed decisions. When considering buying a stock, you want to know how many other people want to buy it and at what price. That's where the order book comes in: it shows you the demand for the stock and how much people are willing to pay for it.

The order book can reveal a lot of information about the current state of the market and the sentiment of investors and traders. For example, if more people are trying to buy a stock than sell it, that's a sign that investors are optimistic about its future prospects. This signal can cause the stock price to go up.

Conversely, if more people are trying to sell a stock than buy, that's a sign that investors are pessimistic about the stock's future prospects. This signal can cause the stock price to go down.

Conclusion

In summary, understanding the order book can be a valuable skill for anyone interested in finance and stock trading, as it provides insight into the behavior of the market and the factors that can influence stock prices.