👾 Game Master

6/21/2022, 3:07:54 PM

Initial Coin Offering (ICO)

Before reading this article, it is highly recommended to have previous knowledge on Decentralization and Decentralized Finance (De-Fi) so that readers can have a better understanding of the decentralized ecosystem.

What is ICO

Initial coin offering, often called ICO, is a process in decentralized finance that resembles the Initial Public Offering (IPO) process in traditional finance. ICO is a popular way decentralized companies choose to raise funds for future business operations.

Image source: https://media.warriortrading.com/2018/01/Blog_ICO1.jpg

How Does ICO Work?

During the process of ICO, investors can invest in the company and receive a newly created cryptocurrency token issued by this company. This token can either represent the service or product the company provides or simply a representation for stake ownership.

ICO Process

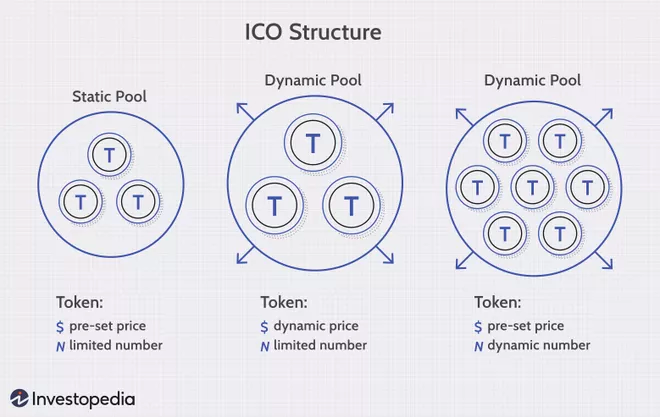

In a standardized ICO process, the initiator of the project and the company need to choose one of the structures of ICO. Some of the common structures include:

- Static Pool:

- A predetermined funding goal/limit is set. The total number and price for tokens in the pool are fixed.

- Dynamic Pool (1.0)

- The token price is static, while the total amount of tokens is fixed.

- Dynamic Pool (2.0)

- The amount of tokens is static, while the token price is fixed.

Regulation

A key feature to note about ICO is that anyone can launch an ICO. There are few regulations around the process of ICO, in contrast to the sophisticated and highly standardized IPO process (which is supervised by centralized authorities).

The lack of regulation lowers the barrier to funding and exposes more businesses to possible funds. However, the lack of regulation also increases the possibility of fraud and scams. Therefore, it is especially crucial for investors who are interested in ICO to do sufficient research before investing in a type of crypto asset so that the probability of investing in a scam business can be minimized.