👾 Game Master

6/21/2022, 6:30:13 AM

Debt-to-Capital Ratio

What is Debt? Is It Good?

- Pro: Taking a few amount of debt is helpful, because it helps increasing the profit. Imagine that you have $100 now. If you invest these 100 dollars in the stock market, you could gain a return of 10%, which is $110 in total. However, there is another way to “leverage” your returns. With the $100 you have, you can borrow an additional $50 from the bank. Now, if you invest the $150 in the stock market, instead of $110, you now have a net asset of $165 (which is 55 dollars more, even if you pay the $50 dollars back, you still earn $5 more)! Imagine if instead of $100, you are leveraging millions of dollars... The difference will be gigantic.

- Con: According to the risk-return relationship, when an investment provides a higher return, one must be aware, because potentially, there might also be a higher risk. This is the same for leverage. By reading the benefits leveraging can provide, are you intrigued by this “magical strategy”? However, there is a cost. What if you borrowed $50 to invest in a stock, but instead, you had a -10% of return? Now, not only you cannot pay back the interest, you also cannot pay back the original debt. If we magnify this scenario, instead of $50, you are borrowing $5 million. Now you know the real problem...

“Some investments do have higher expected returns than others. Which ones? Well, by and large they're the ones that will do the worst in bad times.” ——William Sharpe

Back to companies, the pros and cons also applies to a company’s financials. Not enough debts might imply the company not “leveraging” its assets effectively, but too many debts indicates there is a potential risk that the company cannot pay back its debts. Balance is the key.

Calculation

Debt-to-Capital = Debt ÷ (Debt + Equity)

Application

Since the asset structure varies between industries, markets, and countries, it is important to compare the debt-to-capital ratio with companies with similar characteristics. This is why the debt-to-capital ratio is also called a relative valuation metric.

Also, it is worth noticing that the asset structure also could vary between companies because there are always different events happening to different companies. Therefore, understanding the story behind the number is the most important step.

Comparison

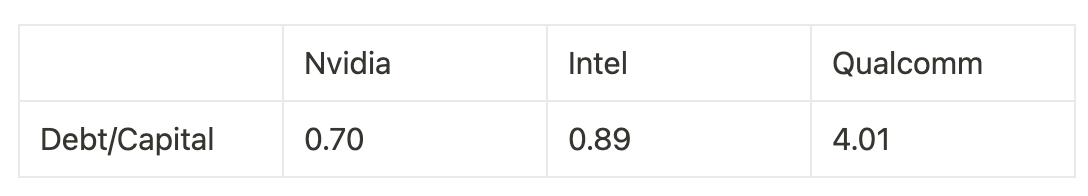

Here is a debt-to-capital ratio calculation for the three companies, Nvidia, Intel, and Qualcomm. They are all well-known companies in the semiconductor industry.

According to the calculated data above, it is obvious that Qualcomm has a higher value, which implies a potential risk for the company to take too much risk.

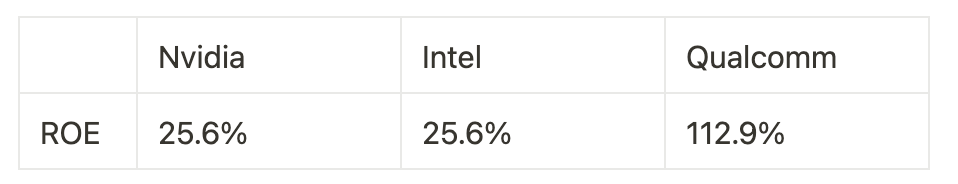

It is also worth noticing the connection between financial leverage and ROE. The table below shows the value of ROE for the three companies.

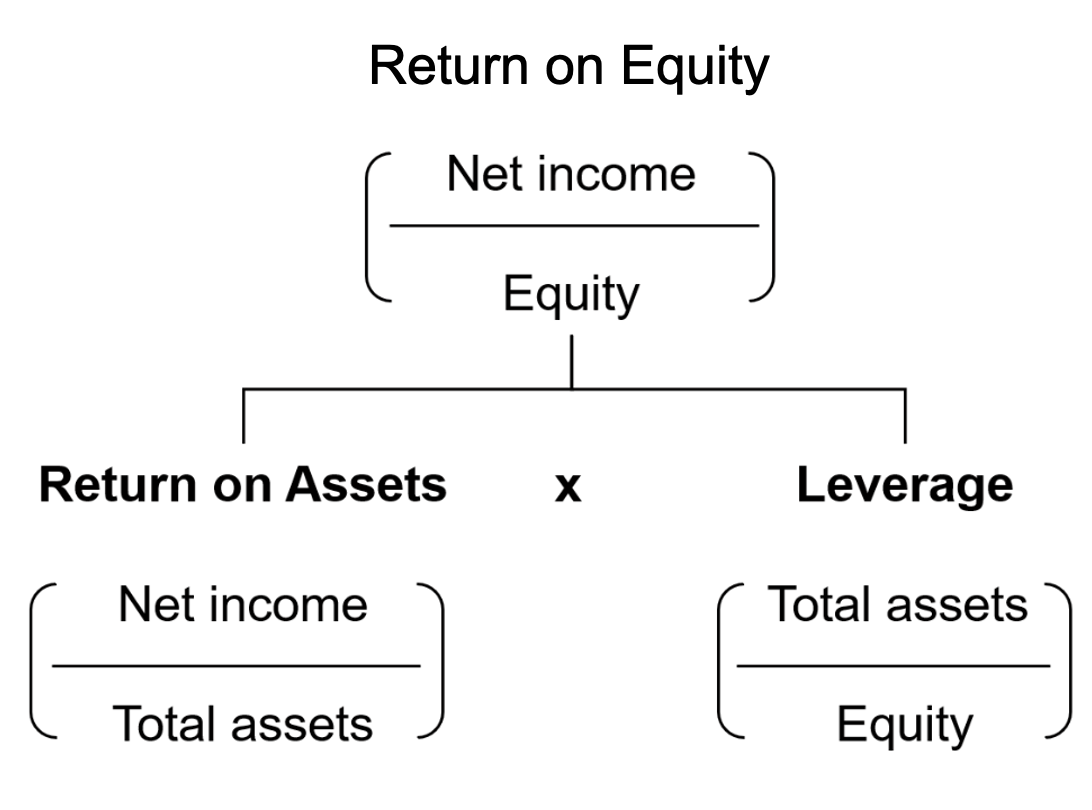

We can see that Qualcomm both has an extremely high debt-to-capital ratio and a high value of ROE (return on equity). This is because ROE takes into consideration of financial leverage, which differentiates itself from ROA.

Now we have identified the problem, it is also very important to conduct sufficient research to understand the reason behind this high value. This step is always the key to success when analyzing companies.