👾 Game Master

6/21/2022, 11:59:16 AM

CAPM

What is the CAPM Model?

Understanding a Portfolio

A portfolio, in the investment world, is a collection of invested assets. By distributing different amounts of money invested into each asset, we give these assets various “weights” in our portfolio. As technology improved, more and more novel portfolio management methods were invented, aimed to maximize the expected return. However, as you may have heard, one of the most classical and famous portfolio management tricks is to “not put all your eggs in one basket.” Well, this saying is actually backed up by a very famous and important financial theory, which is the combination of CAPM and portfolio management theory we will introduce in this article.

Brief Look Into CAPM

The Capital Asset Pricing Model, often abbreviated as CAPM, is a classical methodology for estimating the expected return of equity (i.e. the expected return for investing in a certain stock) based on the analyses of risks. Before digging deep into this model, it is worth mentioning that the CAPM Model assumes an ideal situation, which in the real world scenario, often oversimplified the factors. Therefore, professional financial managers tend to associate the model with other methods to develop a realistic and effective calculation for the expected return. Yet CAPM and its related portfolio management approaches are often viewed as theoretically accurate, which is why it is still used by many investors.

As mentioned above, CAPM calculates the expected return by analyzing the corresponding risk of the asset. The model assumes that in order for an investment to generate additional returns, more risks have to be taken by the investor. This assumption is originated from the famous Modern Portfolio Theory and Efficient Market Hypothesis (EMH).

By applying CAPM, investors can calculate the trade-off between risk and return, therefore finding the portfolio combination that will bring them the highest expected return while minimizing the risk.

Calculation and the Principle Behind CAPM

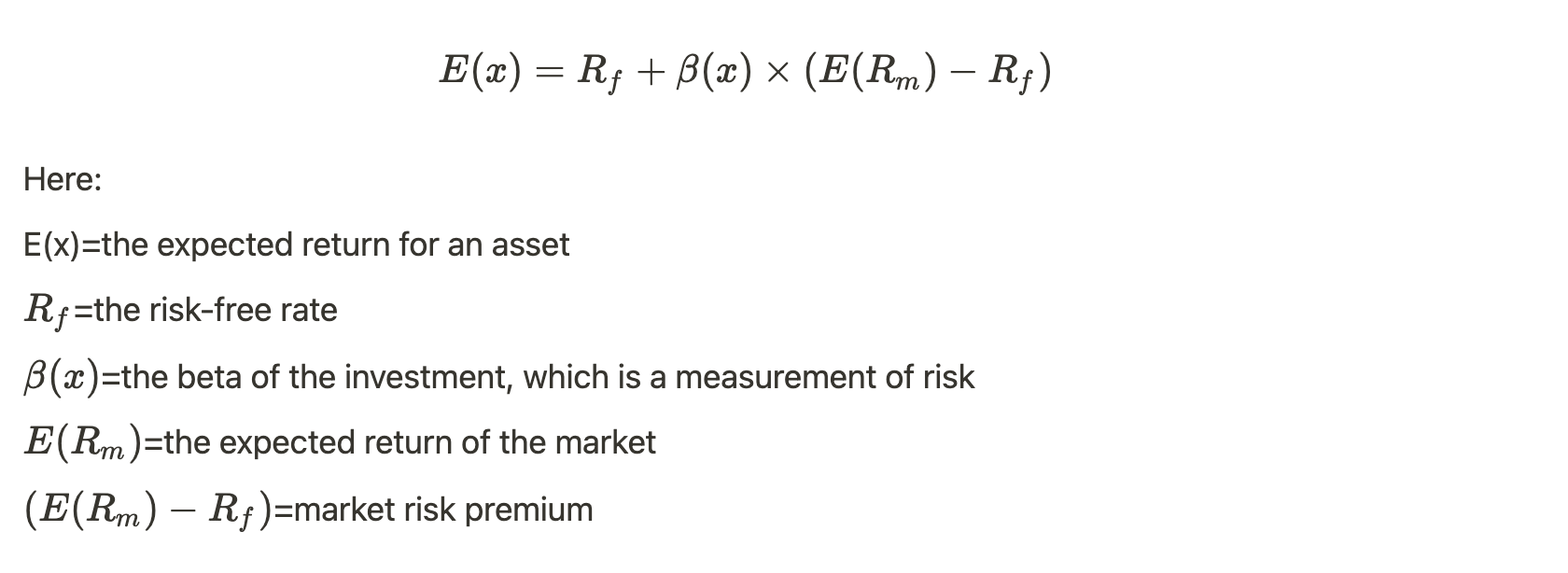

According to the Efficient Market Hypothesis (EMH), the market (i.e. the entire stock market) alone is already the most “efficient” asset combination, because it is diversified. Therefore, in order to target a higher return rate, more risk must be taken by the investor. The sentence described in the words above is then quantified into the formula below:

In the following text, we will specifically discuss more details about the parameters in the equation.

Risk-Free Rate

The CAPM assumes two costs that the investors have to take in order to target more return: 1. Time Value of Money (TVM) (click on the article link to learn more) 2. Taking additional risks. The risk-free rate accounts for the cost brought by the Time Value of Money and is often calculated from the U.S. bond yield.

Beta

Beta accounts for the second cost that the CAPM modifies, which is the additional cost for an investor to take in order to outperform the market. To learn more about Beta and its calculation, view: Beta (β).

Market Risk Premium

The market risk premium is the expected return from the market, subtracting the risk-free rate.

Further Extension

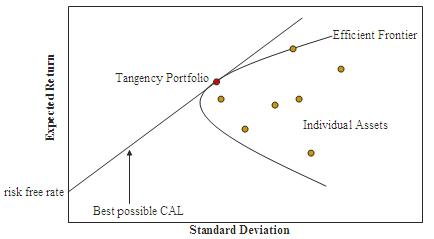

You may already observe the fact that the CAPM equation is actually a linear relationship between the expected return and the expected risk. If we can find a relationship that perfectly optimizes the risk-return trade-off, and we plot the line we just found together with an efficient frontier, we can get the following result:

The intersection between the efficient frontier and our CAPM linear function will then be the so called efficient portfolio (link here to Efficient Frontier and Efficient Portfolio) (or optimized portfolio).