👾 Game Master

6/17/2022, 4:00:56 AM

Depreciation

What is Depreciation?

Depreciation is an accounting method to spread the cost of a tangible asset (physical asset) across its life expectancy (expected useful life). It follows the GAAP, which is a set of rules used by most accountants in the United States (some other countries may use rules like IFRS). Through depreciation, the company legally increases its profit within the timeframe and reduces the tax for that piece of asset.

Why Depreciation?

Machinery, equipment, and other tangible assets are usually expensive. However, there is often a limited life expectancy for these machines to work. The nearer it approaches the life expectancy, the less effective this machine works. This applies to most tangible assets. For example, a car runs the best when someone first purchases it, and as time goes on, different problems will emerge, and a car is often expected to run for at most 15 years.

Therefore, instead of listing the money used to purchase the asset all in one year (or one period), a more optimal and logical way is to allocate the cost across different years (or a certain period of time).

How to Depreciate?

There are several ways to depreciate an asset over its life expectancy. Before understanding the specific methods, there are some concepts worth learning.

Let’s imagine that company X had bought 100 new trucks 🛻. Each truck costs $1000, which in total, they cost $100,000. Since a truck is a tangible asset and its functions will gradually become less useful, it follows the depreciation rule.

In this case, according to the expert’s estimation, the life expectancy for these trucks is 15 years.

- Carrying Value: As mentioned, depreciation is a process that splits the cost of assets over different periods of time. Now, what if company X hopes to sell the trucks after using them for 5 years? If we assume the depreciated value each year is $50 per year per truck, then at year 5, one truck will be worth $750, and 100 trucks will be worth $75,000. $75,000 will be the carrying value at year 5.

💡 Carrying value is the estimated book value for an asset taking into account depreciation.

Carrying Value =Original Cost -Accumulated Depreciation

You may already guess, yes, carrying value will change each year, due to depreciation.

Salvage Value: After 15 years, company X hopes to sell these trucks. Although they might not be working anymore, trucks are still metals. There is some remaining value in the truck, even though it might not be valuable for company X anymore. Here, if company X wants to sell the trucks, the money they can sell is the salvage value.

- Salvage value is the estimated book value after the depreciation process is completed.

Straight-Line

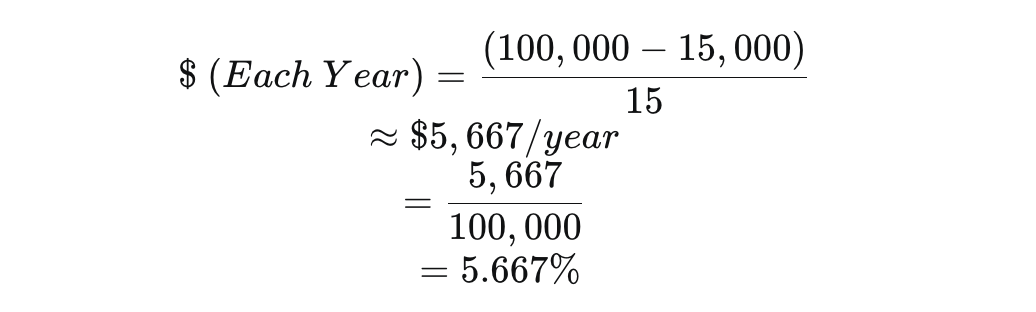

The straight-line method is the easiest type of depreciation method. It splits the cost equality between each time period until the asset reaches its life expectancy. Let's use the same example as above. Through estimation, we know that the salvage value of these trucks will be $150 per truck. The depreciated value according to the straight-line method is calculated as below:

Declining Balance

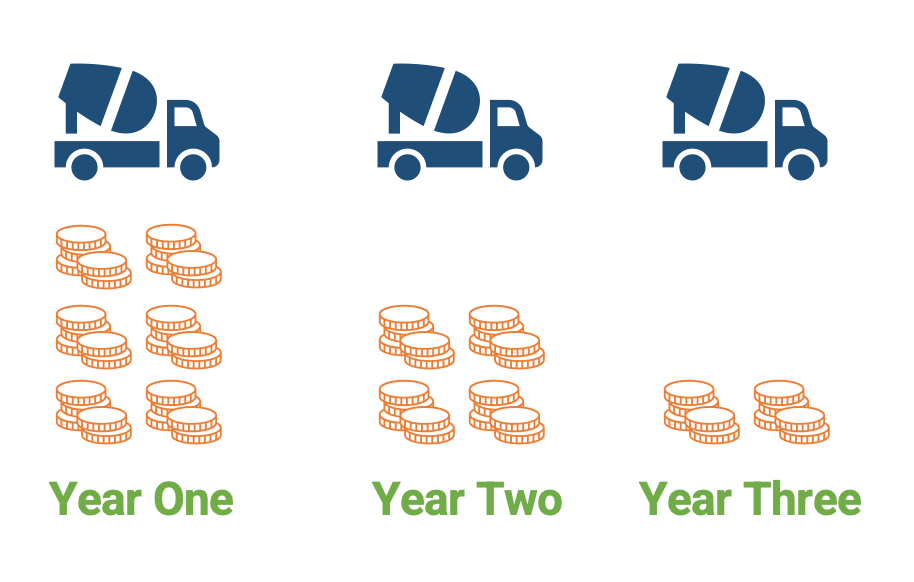

Declining balance is a type of accelerated depreciation. It is based on our real-world situation that an asset is most likely to work more effectively in its early stages and less efficiently when it turns old.

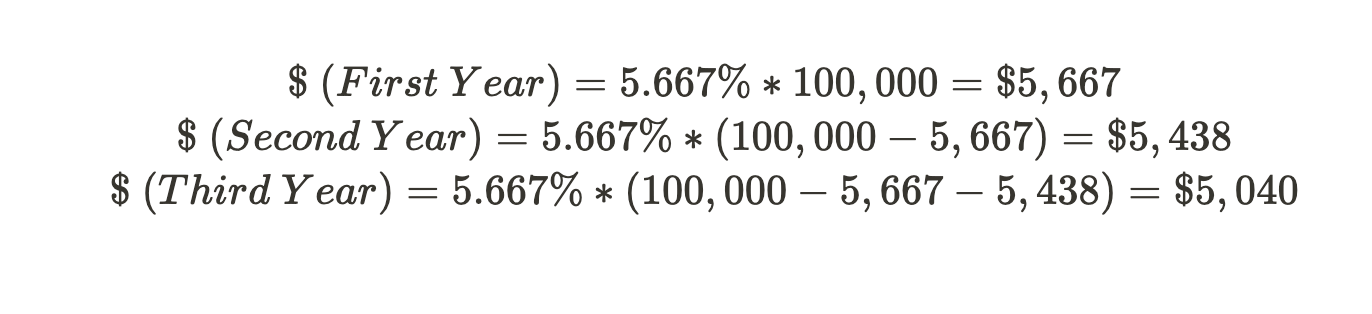

Using the same example as above, the depreciation process using the declining balance is: