👾 Game Master

6/21/2022, 8:01:13 AM

Discount Rate

What is Discount Rate?

The discount rate is an essential metric in financial valuations. Through various valuation methods, investors are capable of forecasting the future value of a company. But instead of future value, investors are more interested in its “real” current value, AKA the intrinsic value, because it provides information to show whether a deal is worth it (such as purchasing a stock). Comparison between the intrinsic value and the market value helps determine whether the company is overvalued or undervalued by the market. To do so, we need to form a calculation that can “discount” the forecasted future value back into the current value, and there comes the discount rate.

The discount rate is based on the Time Value of Money (TVM) theorem, which states that money today is worth more than money in the future. This is because of the “opportunity cost” or the implicit cost brought by time. For example, if one chooses to purchase an asset worth $200 instead of investing $200 in the bond market with an interest rate of 10%, then the 10% becomes the opportunity cost for this investment. Therefore, if we know the anticipated future value of the investment, we can set the 10% as our discount rate to derive the intrinsic value and compare it with today’s market price.

Specific applications using the discount rate can be found in: Present Value (PV) and Net Present Value (NPV), DCF: Using Excel.

In company valuation, investors usually choose Weighted Average Cost of Capital (WACC) as a discount rate for the company’s anticipated future free cash flow. Details and the reasons can be found within the WACC article.

Formula

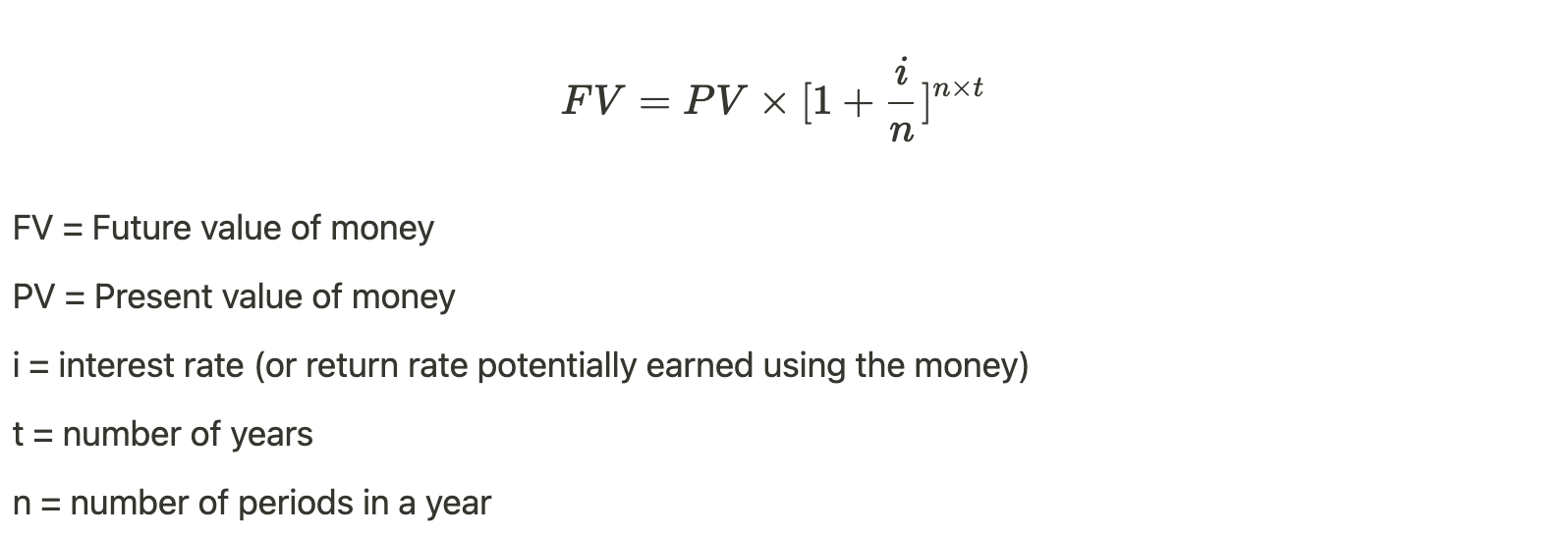

The formula for discounting the future value is as follows:

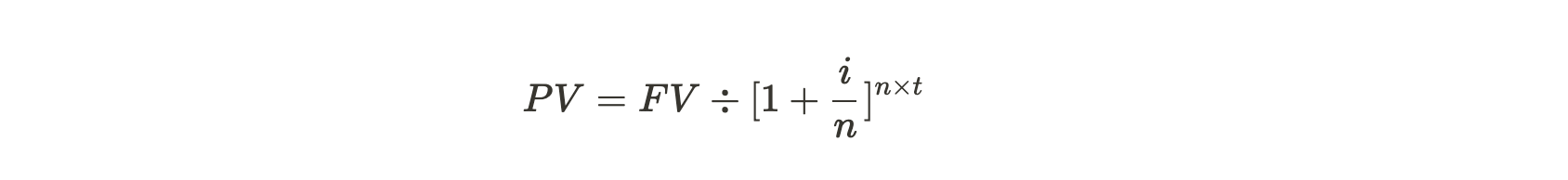

Alternating the two sides of the equation, we get:

This formula builds the core for many significantly essential fundamental finance applications, including the DCF model mentioned above and the Gordon’s Dividend Model.