👾 Game Master

6/21/2022, 11:59:29 AM

Risk-Return Tradeoff

What is Volatility?

In finance, volatility is often used interchangeably with “risk”. The volatility of an asset, such as a stock, is measured by how fluctuating the price is during a range of time. If we observe the stock price carefully, we can see that the price change generally follows a smooth trend, meanwhile, the short-term price changes are often wavering around the trend. This wavering price is the volatility of the stock price.

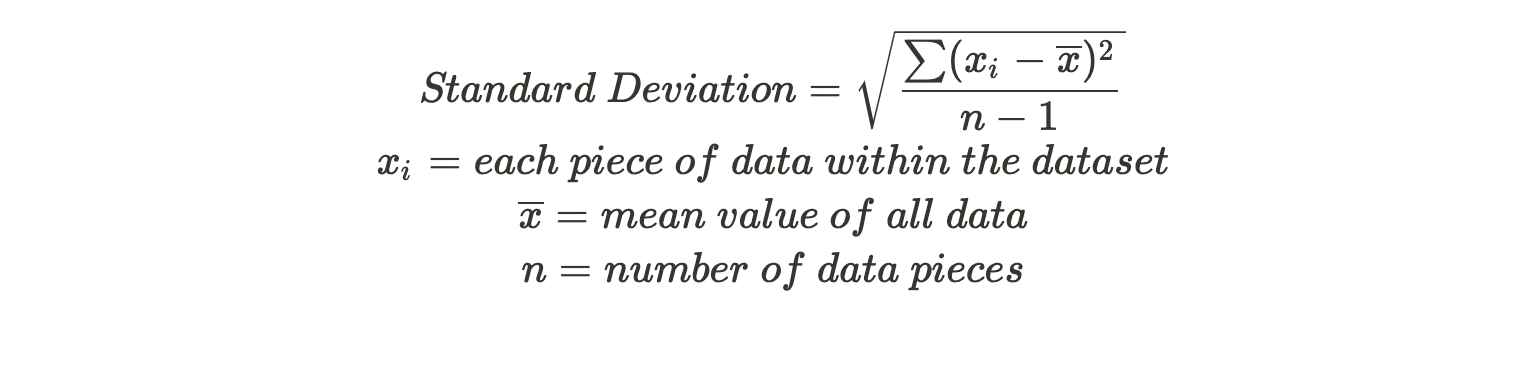

There are several indicators that can be used to quantify the volatility. Some examples are standard deviation, volatility, mean-square error, etc. Among these indicators, the most commonly used is the standard deviation. A detailed explanation for standard deviation can be viewed in the article: Standard Deviation and Correlation.

What is the Risk-Return Tradeoff?

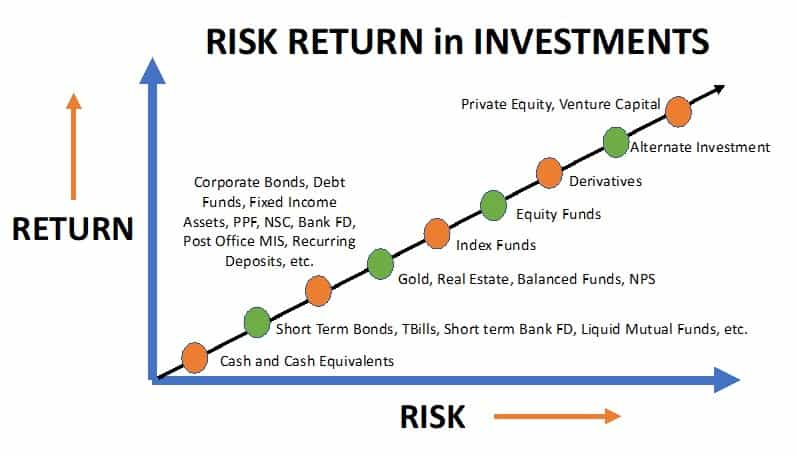

The risk-return tradeoff is a key concept in modern portfolio management and asset selection. It is generally believed that for investors to gain more return, higher risks must be taken. The risk-turn tradeoff also plays a crucial role in the Efficient Market Hypothesis (EMH) and the Modern Portfolio Theory. The following graph depicts a risk-return tradeoff for some of the common types of investments:

Why is the Tradeoff Important?

In portfolio management, a more diverse (which means that the portfolio contains more types of assets) asset combination can yield a less risky (and lower return) portfolio. The risk-return tradeoff is important because it provides a standard for investors to weigh their goals. For investors who aim for high returns and are capable to take more risks, a high risk-return investment such as derivatives is a suitable choice. On the other hand, for investors who seek safe and stable returns, investments such as bonds or ETF funds are the top choices.

It is also worth noticing that the risk-return tradeoff might vary according to individual investors’ sentiments. The three types of risk-return sentiments are Risk-Averse, Risk-Neutral, and Risk-Seeking.