👾 Game Master

6/21/2022, 8:05:46 AM

Alpha (α)

What is Alpha?

In finance, alpha(α) is also called “excess return”, because it measures an investment’s ability to upbeat the market. According to the Efficient Market Hypothesis (EMH) the market provides the most efficient rate of return, making individual investments nearly impossible to exceed the return rate of a market (because of the market’s risk efficiency). This way, alpha is also referred to as the “abnormal rate of return”.

Alpha (α) is often used in conjunction with Beta (β), which is a measurement of volatility (risk). Alpha measures active investment strategies, but beta can be applied to both active and passive strategies. The reason is that alpha is an indicator of “performance”, and active portfolio managers often seek to gain positive alpha through actively manipulating the investment combination to upbeat the benchmark.

Application

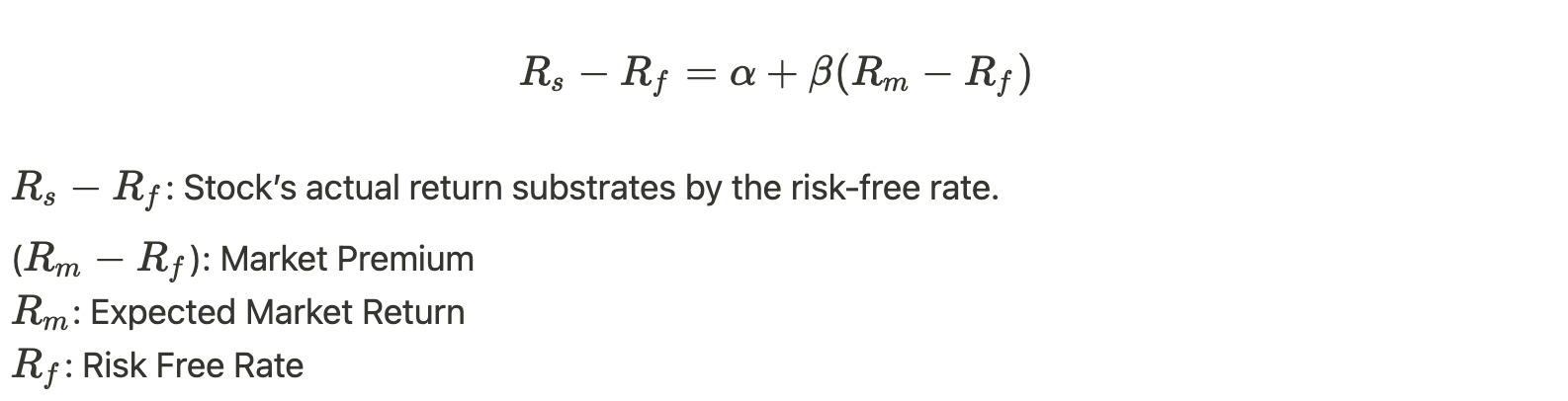

Alpha might sound like another fancy “finance thing”, but actually, it’s straightforward and easy. There are many ways to visualize Alpha and Beta (i.e. through Excel). The mathematical equation that modifies Alpha & Beta’s application is:

Here is a visualization of the regression equation above. For people who are familiar with linear regression, it might be obvious to recognize $\alpha$ as the intercept in modeling a stock’s return.