👾 Game Master

6/21/2022, 7:44:40 AM

Risk-Free Rate (Rf)

What is the Risk-Free Rate?

A risk-free rate is the theoretical rate of return of an investment with zero risk. Practically speaking, there is no absolute “risk-free” investment in the finance world, but in most cases, people refer to the U.S. Treasury bond yield as the risk-free rate, due to its stability and the “promised” return.

If there is a Risk-Free Investment, Why Take More Risks?

People may wonder why investors prefer to take on more risks when there is a risk-free investment? The reason is due to the correlation between risk and return. Depending on the types of investments, the correlation might differ, but in general, low-risk investment acquires low return (some examples are bank savings, bonds, etc.), and high-risk investment acquires high return (i.e. stock, cryptocurrencies, options, commodities, etc.). This relationship is derived from the Efficient Market Hypothesis (EMH). The risk-free rate becomes handy because it measures the minimum return an investor will be looking for, and they will not take more risks unless the investment offers a higher rate of return.

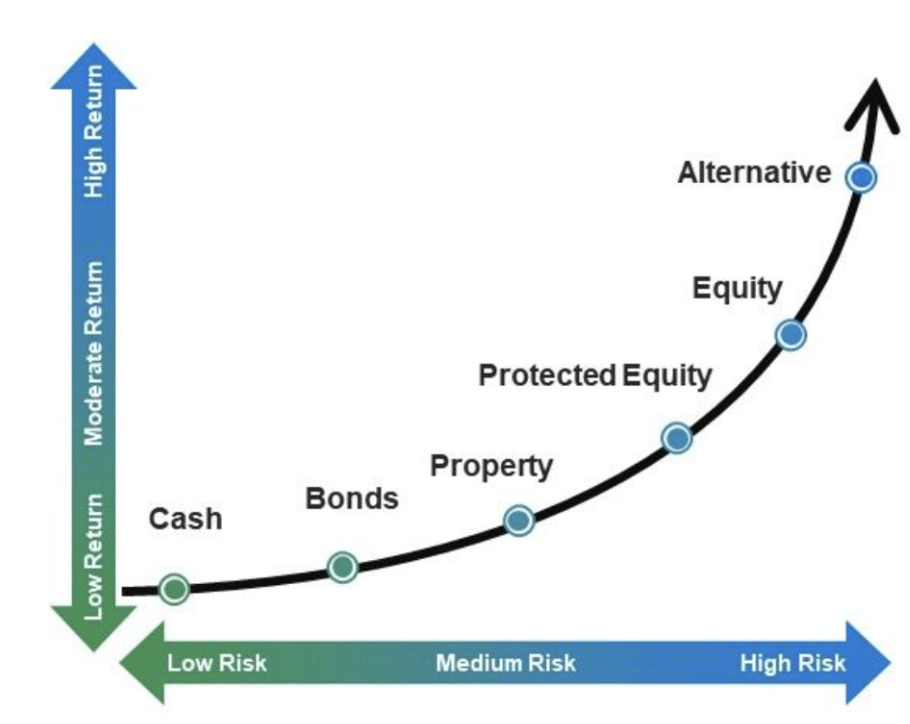

Graph Demonstration

As mentioned above, the risk of investment varies among various types of assets. Below is a clear graph describing the risk corresponding to each type of investment.

Risk-return relationship graph for various financial assets.