👾 Game Master

6/17/2022, 5:26:13 AM

Net Working Capital (NWC)

Measurement

The net working capital (NWC) measures a company’s

- financial health

- liquidity

- operational efficiency

If a company has a positive NWC, which means a higher current asset than current liability, the company is likely to have a healthy financial structure and a space for the company to re-invest its current asset to expand the business. On the other hand, if there is a negative NWC, meaning more current liability than a current asset, then there might be a risk that the company may not be able to pay back its debts.

However, a high NWC is not always a healthy signal. A positive NWC may indicate that the company has assets for growth, but an abnormally high NWC may suggest that the company holds excess current assets and inventory, which signals operating inefficiencies.

Calculating

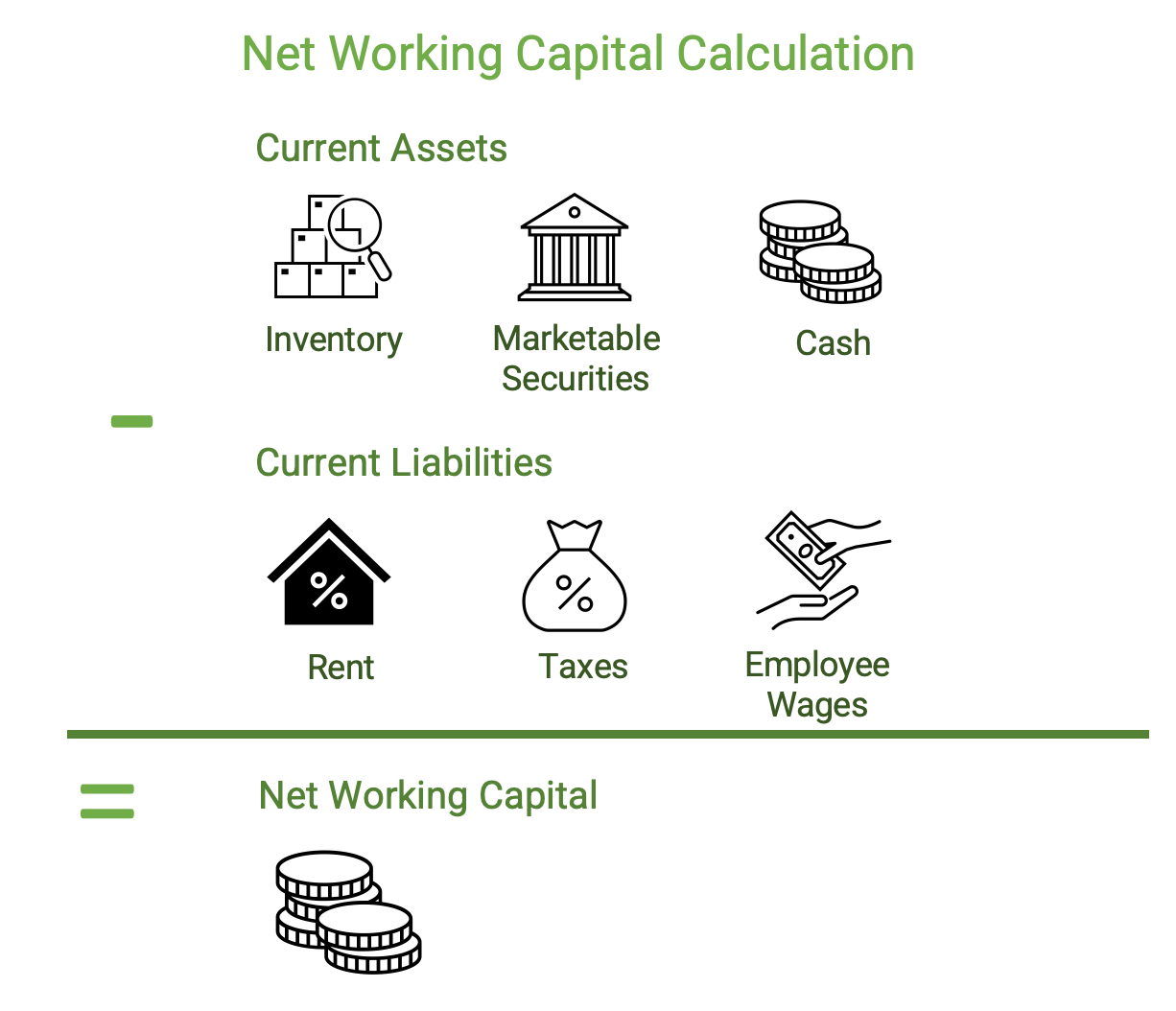

The net working capital is a straightforward concept shown in its calculation:

NWC = Current Asset -Current Liability

NMC: net working capital

To understand what are some examples under each of the sections, check out the graph below: