Stock Price Chart

W

Wakron, Inc. ?

APINX

N/AASD

N/A (N/A %)

Market OPEN

| LAST CLOSE | MARKET CAP | 7D TREND | 1Y TREND |

|---|---|---|---|

| ASD N/A | ASD N/A | ASD N/A | ASD N/A |

Ask and Bid Price: Order Book

| Price | Quantity | Trade Order |

|---|---|---|

| 0 | 0 | |

| 0 | 0 | |

| 0 | 0 | |

| 0 | 0 | |

| 0 | 0 |

| 0 | 0 |

| 0 | 0 |

| 0 | 0 |

| 0 | 0 |

| 0 | 0 |

Trade Stock

Multi-Dimension Check

Analyzing stocks from multiple aspects to get a well-rounded snapshot.

WRKN Stock Overview

Wakron, Inc. (WRKN) is a technology company headquartered in California, United States. The company develops products for people to connect and socialize with friends, families, and partners. Wakron’s main product WaKO, a decentralized platform for users to chat in text, video calls, and groups.

About this company

OPPORTUNITIES

★ Earnings are forecast to grow 24.56% per year.

★ Earnings grew by 125.45% over the past year.

RISKS

⚠ Significant insider selling over the past 3 month.

⚠ Shareholders have been diluted in the past year.

Company Activity Timeline - Will Be Refined Next Season!

Company Statistics

| Last Updated Data | Next Update |

|---|---|

| Jul 15, 2022 | TBD |

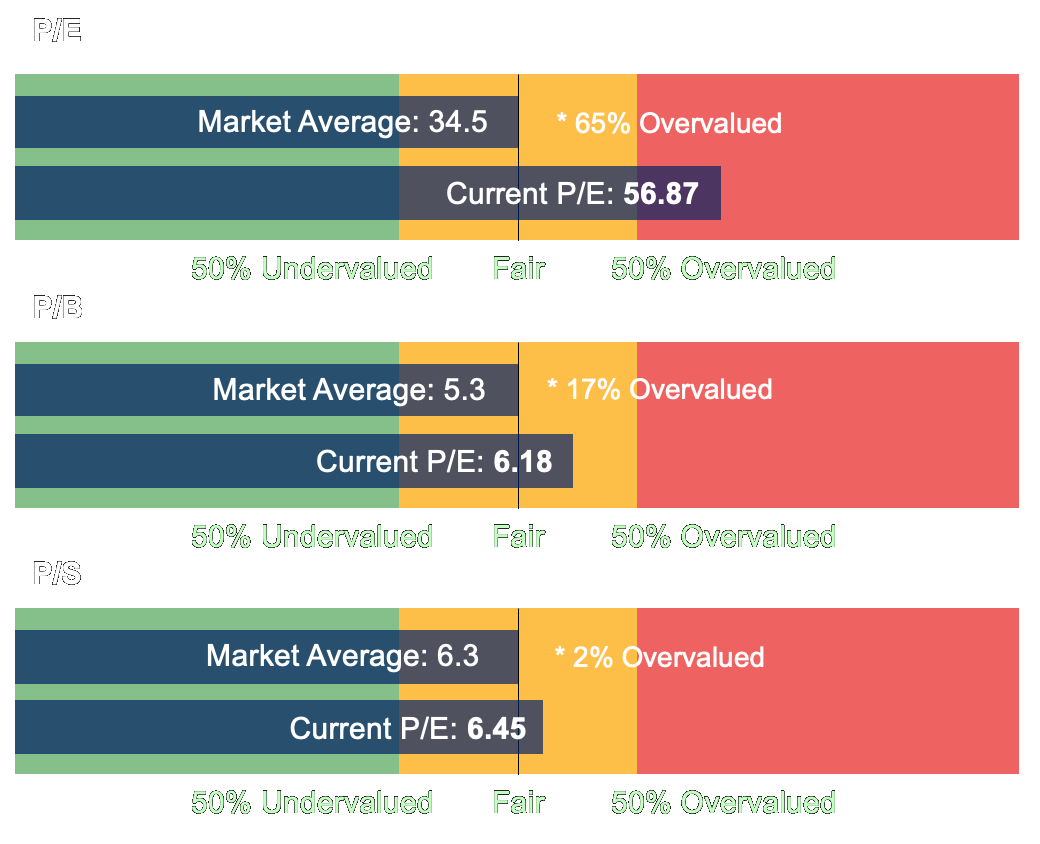

✕ P/E ratio: overvalued compared with industry average.

✓ P/B ratio: undervalued compared with industry average.

✕ P/S ratio: overvalued compared with industry average.

| Price-to-Earning (P/E) | 73.8 |

| Price-to-Book (P/B) | 4.54 |

| Price-to-Sales (P/S) | 8.24 |

Important Events

Wakron's Wild Ride: Tech Company's IPO Brings Excitement and Risks

Pre-IPO prediction and summary.

⚡️

Wakron, a technology company, recently went public through an initial public offering (IPO) after years of resistance from its CEO.

⚡️

Wakron's IPO caused excitement among individual investors and was predicted to be one of the biggest in history, but financial analysts had mixed opinions about the company's performance.

⚡️

While Wakron's successful IPO and strong financial performance are promising signs, it's important for investors to do their own research and exercise caution, as the tech industry is volatile and investing in a newly public company carries specific risks.